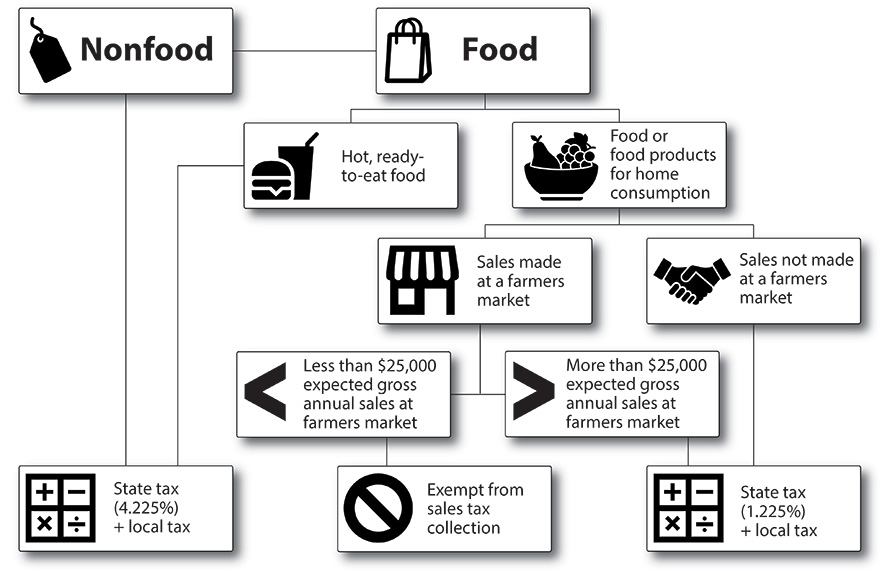

Missouri currently has two state sales tax rates: 1.225% for food that can be purchased with federal Supplemental Nutrition Assistance Program (SNAP) benefits and 4.225% for all other retail sales. In addition to the state sales tax, each city, county and special district can elect to impose a local sales tax. This publication addresses Missouri’s state tax rates as described by state statute RSMo Section 144.527 and administered by the Missouri Department of Revenue (MO DOR), Missouri’s governing body for taxation. For specific local tax rates, please visit the MO DOR Sales/ Use Tax webpage.

Missouri’s sales tax

All food sold in Missouri, other than prepared food fit for immediate consumption and hot foods, are taxed at 1.225% plus local tax rates. Prepared food fit for immediate consumption and hot foods are taxed at 4.225% plus local tax rates.

In 2014, Missouri established an exemption (RSMo 144.527) for the collection and remittance of state and local sales tax for farm products sold at farmers markets. MO DOR provides an industry tax matrix for farmers markets (PDF) that provides industry guidance on what sales and purchases are taxable and exempt by businesses in the farmers market industry. For the purpose of this exemption, farm products are defined as:

- Fresh fruits

- Vegetables

- Mushrooms

- Nuts

- Shell eggs

- Honey or other bee products

- Maple syrup or maple sugar

- Flowers

- Nursery stock and other horticultural commodities

- Livestock food products, including:

- Meat

- Milk

- Cheese

- Other dairy products

- Food products of aquaculture, including:

- Fish

- Oysters

- Clams

- Mussels

- Other molluscan shellfish taken from the waters of the state

- Products from any tree, vine or plant and other flowers

- Any of the above products that have been processed by the participating farmer, including, but not limited to, baked goods made with farm products

The exemption defines farmers markets as: an individual farmer or a cooperative or nonprofit enterprise or association that consistently occupies a given site throughout the season, which operates principally as a common marketplace for an individual farmer or a group of farmers to sell farm products directly to consumers, and where the products sold are produced by the participating farmers with the sole intent and purpose of generating a portion of household income.

The exemption also has an exclusion. If a person or entity has an estimated total annual sales of $25,000 or more from participating in farmers markets, they cannot utilize the farmers market sales and use tax exemption. This person or entity will need to collect and remit state and local sales taxes.

Determining whether you need to collect sales taxes

To determine whether you should register your business with MO DOR to collect and remit Missouri’s state and local sales taxes, work through the following questions:

- Are you a Missouri resident or business?

- No: Please read about the Missouri use tax.

- Yes: Go to Question 2.

- Did you sell food intended for consumption at home?

- No: Register your business with MO DOR.

- Yes: Go to Question 3.

- Did your sales take place at a farmers market as defined above?

- No: Register your business with MO DOR.

- Yes: Go to Question 4.

- Do you expect to have less than $25,000 in estimated total annual sales from participating in one or more farmers markets as defined above?

- No: Register your business with MO DOR.

- Yes: Do not collect state and local sales taxes; you are exempt.

If you answered no to questions 2 through 4, you need to collect and remit Missouri’s state and local sales taxes.

You will need to register the business online or submit a Missouri Tax Registration Application (Form 2643) (visit the MO DOR Business Tax Registration webpage for more information). If you are doing business under a name that isn’t your legal name, you will first need to register your business name as a fictitious name with Missouri Secretary of State’s office.

Once you have your permit, ensure you are charging the proper state (Figure 1) and local tax rates. If local tax rates are changed, the increase or decrease usually takes effect on the first day of the calendar quarter. MO DOR will email changes to the address on file if one is available. If an email address is not available, rate changes will be mailed to the address on file. If you make sales in different locations, be sure you check the MO DOR website for any changes. Failure to be notified does not relieve you of the tax.

Remitting sales taxes

Your business will remit all state and local sales taxes collected to the state, and the state will distribute the local tax to the locality. The remittance date depends on how much sales tax you collect and is determined with the Missouri Tax Registration Application (Table 1).

Table 1. Missouri sales tax remittance schedule.

| Estimated sales tax collection | Remit | Remit |

|---|---|---|

| Less than $200 per quarter | Annually | By Jan. 31 of the following year |

| Less than $500 per month | Quarterly | By the last day of the month following the end of the quarter |

| $500 or more per month | Monthly | By the last day of the following month |

| For additional information, refer to the Sales Tax FAQs from the Missouri Department of Revenue. | ||

Sales tax rates and policies are subject to legislative changes.

Acknowledgement: Thank you to the Missouri Department of Revenue for reviewing this guide.

This work is partially supported by the U.S. Department of Agriculture’s (USDA) Farm Service Agency through project award number FSA23CPT0012862. Its contents are solely the responsibility of the authors and do not necessarily represent the official views of the USDA.