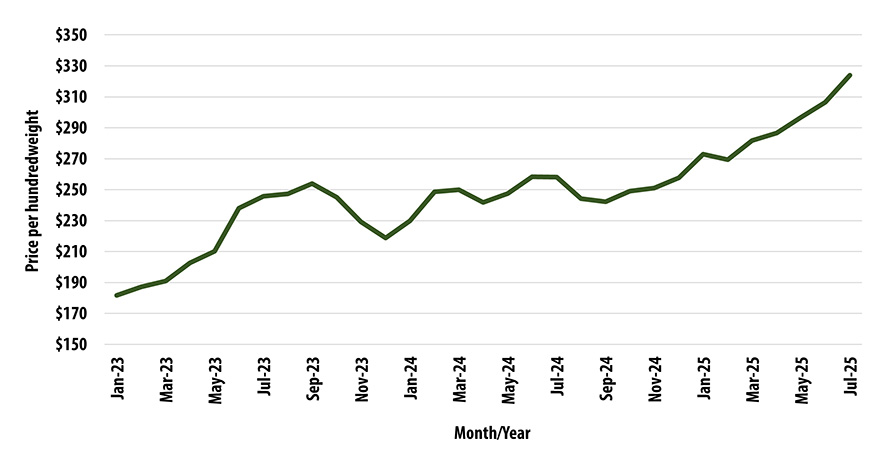

Livestock risk protection (LRP) insurance offers producers a way to manage risk associated with declining livestock prices (Figure 1 shows the historical trend for feeder cattle future prices). It does not protect against other perils such as disease or death. The U.S. Department of Agriculture’s (USDA) Risk Management Agency (RMA) administers LRP insurance products. It is sold by approved livestock insurance agents throughout the year (running from July 1 to June 30). LRP premiums may be subsidized by the federal government if the producer meets conservation compliance, and additional subsidy is provided for beginning farmers or ranchers and veteran farmers or ranchers. Policies are available in Missouri for feeder cattle, fed cattle and swine. Insured producers receive an indemnity when the actual ending value of livestock, as determined by the RMA, is less than the coverage price chosen by the producer.

How LRP insurance works

A producer must use an agent authorized to sell livestock insurance. The producer fills out an application to determine eligibility. Once the application is accepted by USDA, the producer can purchase a specific coverage endorsement (SCE). An SCE requires specific information regarding the livestock to be insured:

- Number, livestock type and target weight

- End date (based on insurance period)

- Coverage price

- Ownership share (percentage)

Producers indicate the type of livestock to be covered and estimate their target weights at the end of the insurance period. Breed, sex and target weight category will adjust coverage prices for feeder cattle. The end date should be close to when livestock are to be marketed or reach the target weight. The coverage price is a percentage of the livestock’s expected ending value at a contract’s expiration date. Producers must also indicate their share of ownership (must be greater than 10%), which adjusts the insured value accordingly.

LRP can be purchased for possessed animals — born or will be born — or for forward contracted animals, as long as the producer receives possession at least 90 days prior to the end date of the SCE.

When a policy can be purchased

Feeder cattle, fed cattle and swine policies can normally be bought on weekdays, excluding holidays and when related USDA reports (for example, Cattle on Feed; Hogs and Pigs) are announced. The time frame for purchasing an SCE starts at 3:30 p.m. and ends at 8:25 a.m. Central time the next day. Coverage levels and rates are updated each business day using market data published by the RMA. These values are posted on the RMA website. If the RMA website offers no coverage and prices, producers will be unable to buy LRP insurance for that day. The RMA also reserves the right to suspend sales at any time due to market limitations or volatility.

Premiums

Premiums are due on the first day of the second month following the SCE end date. Premium costs increase when selecting higher coverage levels and longer insurance periods. Premium costs are subsidized by the federal government, but the producer must be in conservation compliance to qualify. The percentage of subsidy varies by the coverage level selected (Table 1).

Table 1. Federal government subsidies for livestock risk protection insurance, by coverage level.

| Coverage level | Subsidy |

|---|---|

| 75% | 55% |

| 80% | 50% |

| 85% or 87.5% | 45% |

| 90% or 92.5% | 40% |

| 95% to 100% | 35% |

If you qualify as a beginning farmer or rancher or a veteran farmer or rancher, your premium subsidy will generally be 10% higher than the standard subsidy.

Premiums are calculated in the four-step process detailed below. LRP coverage prices, rates, and producer premium costs are publicly reported by the RMA. The actuarial rate is the rate set by the RMA, based on market conditions, used to calculate the premium before any subsidy is applied.

Indemnity

Indemnities are paid at the end of the insurance period, after premium costs are deducted. Payments are based on the difference between the actual ending value and the coverage price selected by the producer. If the actual ending value is higher than the coverage price, no indemnity will be paid. To collect the indemnity, a Notice of Probable Loss form must be submitted within 60 days of the policy’s end date. Proof of ownership or sales records are required before the indemnity is paid. Payments will be made within 30 days of a properly filed claim.

If the livestock are sold more than 60 days before the SCE end date, the producer becomes ineligible to receive an indemnity unless ownership is correctly transferred according to policy terms. For feeder cattle only, a drought hardship exemption exists that allows indemnity eligibility if cattle are sold more than 60 days before the SCE end date. Eligibility for this exception is based on data from the U.S. Drought Monitor’s Drought Severity and Coverage Index.

Any animals that die or are quarantined during the insurance period should be reported within 72 hours to prevent a reduction in your policy or payout.

Feeder cattle policy

LRP insurance for feeder cattle can provide coverage for calves (born or unborn), steers, heifers, predominantly Brahman or predominantly dairy cattle (Table 2). Ending weights can be between 100 and 599 pounds (Weight 1) or between 600 and 1,000 pounds (Weight 2). Producers select an available insurance period, ranging from 13 to 52 weeks, ending close to when they expect to market their cattle. Feeder cattle producers can select a coverage level ranging from 75% to 100% of the expected ending value. A maximum of 12,000 head of feeder cattle can be insured under a single SCE, and only 25,000 head in the period between July 1 to June 30.

Table 2. LRP feeder cattle snapshot.

| Type of cattle | Calves (born and unborn), steers, heifers, Brahman cattle or dairy cattle |

|---|---|

| Selling weights | 100 to 599 pounds or 600 to 1,000 pounds |

| Insurance period | 13, 17, 21, 26, 30, 34, 39, 43, 47 or 52 weeks |

| Coverage level | 75%, 80%, 85%, 87.5%, 90%, 92.5%, 95%, 96%, 97%, 98%, 99% or 100% |

| Ending value base | CME feeder cattle index |

| Maximum per SCE | 12,000 head |

| Maximum per year | 25,000 head |

LRP insurance uses the Chicago Mercantile Exchange (CME) feeder cattle index to set ending values. This index uses feeder cattle transactions and reports from 12 major feeder cattle states, including Missouri. A price adjustment factor (Table 3) is used to calculate the coverage price and ending value for the livestock type from the cattle index.

Table 3. Price adjustment factors for feeder cattle.

| Cattle type | Weight 1 (100 to 599 pounds) |

Weight 2 (600 to 1,000 pounds) |

|---|---|---|

| Steers | 110% | 100% |

| Heifers | 100% | 90% |

| Unborn steers or heifers | 105% | N/A |

| Predominantly Brahman | 100% | 90% |

| Unborn predominantly Brahman | 100% | N/A |

| Predominantly dairy | 50% | 50% |

| Unborn predominantly dairy | 50% | N/A |

Fed cattle policy

A fed cattle policy functions similarly to a feeder cattle policy. It provides coverage for steers and heifers expected to reach slaughter weight and grade USDA Select or higher for quality, with a yield grade of 1, 2 or 3. Culled dairy cows marketed for beef, anticipated to fall within the USDA Standard grade or lower, are also eligible for coverage under this policy (Table 4).

Insured fed steers or heifers must weigh between 1,000 and 1,600 pounds live weight when marketed for slaughter at the end of the insurance period. Cull dairy cows must range from 800 to 1,500 pounds live weight. If sales records do not contain live weight, then live weight can be calculated by dividing the hanging weight by 0.6325 for steers and heifers or by 0.55 for cull dairy cows.

Producers select an available insurance period, ranging from 13 to 52 weeks, ending closest to when they will market their cattle. The cull dairy cow insurance period is only 13 weeks. Fed cattle producers can select a coverage price from 75% to 100% of the expected ending value. This policy can insure up to 12,000 head under a single SCE. A total of 25,000 head can be insured in the period between July 1 to June 30.

The price of fed steers or heifers (expected and actual ending value) in the LRP policy is determined by the five-area weekly weighted average direct slaughter cattle reported by the USDA Agricultural Marketing Service. The price category represents live basis steer sales, 35% to 65% choice grade. For dairy cull cows, it is based on the CME feeder cattle index and adjusted by the predominantly dairy cattle factor in Table 3.

Table 4. LRP fed cattle snapshot.

| Type of cattle | Steers, heifers, cull dairy cows |

|---|---|

| Selling weights | 1,000 to 1,600 pounds for steers and heifers; 800 to 1,500 pounds for cull dairy cows |

| Insurance period | 13, 17, 21, 26, 30, 34, 39, 43, 47 or 52 weeks |

| Coverage level | 75%, 80%, 85%, 87.5%, 90%, 92.5%, 95%, 96%, 97%, 98%, 99% or 100% |

| Ending value base | Five-area weekly weighted average direct slaughter cattle, steers, 35% to 65% choice for steers and heifers; CME feeder cattle index for cull dairy cows |

| Maximum per SCE | 12,000 head |

| Maximum per year | 25,000 head |

Swine policy

LRP swine policies allow producers to insure market hogs (born and unborn) as detailed in Table 5. Target weight requirements dictate that swine under LRP coverage must weigh between 140 and 260 pounds on a lean, or dressed weight, basis. To convert to live weight, use the lean conversion factor of 0.74. This adjustment would reflect live weights of 189 to 351 pounds. Insurance periods for unborn swine are available from 30 to 52 weeks. For born swine, available periods range from 13 to 30 weeks. Swine producers can select a coverage price of 75% to 100% of the expected ending value. Contract and yearly limits state that 70,000 head can be covered under a single SCE, and 750,000 head can be insured in the period between July 1 to June 30.

Swine expected and actual end values are based on the price series used to settle the CME lean hog futures contract. This weighted average price is derived from two producer sold data series — negotiated and swine or pork market formula prices — reported by the USDA Agricultural Marketing Service.

Table 5. LRP swine snapshot.

| Type of swine | Market hogs |

|---|---|

| Selling weights | 189 to 351 pounds (live) 140 to 260 pounds (lean) |

| Insurance period | 13, 17, 21, 26 or 30 weeks (born) 30, 34, 39, 43, 47 or 52 weeks (unborn) |

| Coverage level | 75%, 80%, 85%, 87.5%, 90%, 92.5%, 95%, 96%, 97%, 98%, 99% or 100% |

| Ending value base | Weighted average price of lean hogs (based on negotiated and swine or pork market formula price data series) |

| Maximum per SCE | 70,000 head |

| Maximum per year | 750,000 head |

LRP example

A producer in Missouri plans to sell 100 feeder cattle steers at a target ending weight of 750 pounds each. The sale is estimated to occur closest to the 21-week insurance period. The producer owns 100% of the cattle. After reviewing LRP quotes, the producer would like to select a coverage price of $330 per hundredweight (cwt), which is a 96% coverage level. The price adjustment factor is 100% for steers in this weight range (see Table 2), so the coverage price remains $330 ($330 × 100%). The subsidy rate is 35% for a 96% coverage level. The LRP quote reports an actuarial rate of 0.031321.

Premium calculation

This quote represents a producer cost of $5,039.51, or $6.72 per hundredweight.

Indemnity calculation

Using the above example, the actual ending value is reported at $310 per hundredweight at the end of the insurance period. Use the following steps to determine the net gain or loss from an LRP plan.

If the actual ending value was higher than the coverage price of $330 per hundredweight at the end of the insurance period, no indemnity payment would be due. The producer’s net loss would be equal to the premium paid, which is $5,039.51.

Advantages of LRP

- Provides protection against declining livestock prices that could affect a farmer’s ability to obtain a positive return.

- Allows producers flexibility in number of animals to insure — ranging from one head to the maximum head limits per endorsement or year.

- Offers downside price risk protection similar to a put option, with no commissions or margin requirements.

- Coverage prices are updated daily, and coverage is available in all months.

- Subsidies are available to lower producer premium costs.

- Premiums due after the end of the insurance period.

Disadvantages of LRP

- Actual ending values are based on regional or national livestock prices. Basis risk — the risk that the national index price used in LRP will not match the price a producer receives locally — exists, and producers need to understand their local market.

- LRP policies are occasionally unavailable due to holidays, market limitations or an announcement of related USDA reports.

- After an LRP policy is approved by the RMA, the selected insurance period, coverage and marketing timeline are fixed. It is important that producers align their insurance selections with their marketing plans.

LRP compared to other risk management tools

It is important to note that LRP is just one of several price protection tools available to livestock producers.

Livestock gross margin (LGM) is another subsidized insurance product offered by the RMA. LGM offers protection for producers’ gross margin — the difference between revenue from livestock or milk sales and feed costs — and is available for cattle, dairy and swine, although only calf-finishing and yearling-finishing cattle operations qualify. Refer to MU Extension publication G461, Livestock Gross Margin (LGM) Insurance, to learn more.

Put options are another tool, but they have important differences from LRP. Put options require upfront premiums, a working knowledge of the options market, and sometimes margin management. However, put options offer more flexibility with the ability to hedge at a range of prices instead of a set price. Unlike put options, LRP premiums are federally subsidized and only due at the end of the insurance period, which can be advantageous for cash flow.

Forward contracts protect against downward price movements by locking in a guaranteed price but also limit potential gains if market prices rise.

Futures contracts allow direct hedging in commodity markets but require active management, margin monitoring and brokerage fees.

Producers should carefully evaluate which risk management tool — LRP, LGM, put options, forward contracts or futures contracts — best fits their operation, marketing timelines and financial goals.

Resources

- Livestock agent locator

- LRP coverage prices, rates and actual ending values

- Livestock risk protection handbook 2026

The guide is for educational purposes only. The information in this guide does not replace or supersede any procedures or modify any provisions contained in the complete insurance policies