Producers expand their base of operations by purchasing or renting additional land. Some producers may prefer leasing farmland as opposed to purchasing due to a lack of capital, to reserve capital for other purposes, a shortage of land for sale, or the personal belief that leasing farmland is more profitable than owning it. The three most common types of farmland lease agreements in Missouri are cash rentals, flexible-cash leases and crop-share leases. This guide presents information on crop-share leases.

What is a crop-share lease

Crop-share leases compensate the landowner for use of their farmland by sharing the output and typically portions of the inputs of the crop sown by the tenant. A crop-share lease agreement between a landowner and tenant defines how they will share the crop as compensation for their respective contributions in land, labor and capital. Crop-sharing normally involves grain crops such as small grains, corn, milo, soybeans, cotton, hay and rice.

Common crop-share agreements

Landowners’ share of the crop depends on the value of their contribution toward production of the crop. A 2/3-1/3 crop-share arrangement apportions two-thirds of the crop to the tenant and one-third to the landowner. A 50-50 agreement divides the output evenly while typically placing a larger portion of the input burden on the landowner. Other agreements such as 60-40 or 75-25 also occur, but much less commonly. Minimally, landowners contribute land while tenants contribute machinery and labor. However, each crop-share leasing arrangement is unique, reflecting the specific contribution made by each party and the negotiating strength of each party. Crop inputs should be a key element of lease negotiations. Given the legal questions of liability in case of injury or if one party breaches the contract, a written contract is strongly recommended.

Missouri crop-share leasing survey

This guide is based on a 2022 University of Missouri Crop-Share Rental Arrangement Survey. The survey was administered statewide, and responses were received on more than 225 crop-share rental agreements (104 respondents). The values reported in this guide are regional averages; an individual county or area may differ in how a crop-share arrangement is specified. Every crop-share agreement is unique to the parties who negotiated the agreement. The information provided in this guide should be used only as a reference when formulating an agreement between tenant and landowner.

Summary of respondents

The producers and landowners responding averaged a crop-share lease agreement of 576 acres. About one-third of respondents said their leases are renewed annually, another third renew their leases every three to five years, and the final third renewed their leases at a different frequency. The average tenure of a crop-share lease was 18 years. Sixty-six percent of respondents report their leases allocate the output of all crops collectively, with 31 percent of leases allocating output specifically for each commodity raised, and two percent of leases being flexible based on another factor. Leases specifying different output shares for individual crops may do so to reflect vastly different cost structures for each crop, or to make on-farm accounting more simple. Flexible lease agreements split shares based on a factor such as yield, the presence of field tile, or commodity price. On average, the terms of the crop-share agreements reported by respondents to the survey had been in force for five years. This indicates that once a crop-share agreement is decided upon, the agreement typically lasts for several years, potentially due to the tenant and landowner realizing the transaction costs associated with negotiating terms of the agreement more often.

Output share arrangements

Table 1. Reported tenant’s share of output by region and crop type.

| Region/Crop | Tenant’s share of output | |||

|---|---|---|---|---|

| 50% | 67% | 75% | Other | |

| Crop region | Percent of respondents | |||

| Northwest | 100 | |||

| North central | 54 | 23 | 8 | 15 |

| Northeast | 86 | 14 | 0 | 0 |

| West central | 33 | 53 | 0 | 13 |

| Central | 100 | |||

| East central | 50 | 17 | 17 | 17 |

| Southwest | 80 | 20 | ||

| South central | Insufficient responses | |||

| Southeast | 64 | 5 | 31 | |

| Statewide | 50 | 40 | 6 | 4 |

| Crop specific leases1 | Percent of respondents | |||

| Corn | 83 | 6 | 11 | |

| Cotton | 27 | 73 | ||

| Hay | 50 | 50 | ||

| Milo | 100 | |||

| Rice | 40 | 60 | ||

| Soybeans | 100 | |||

| Wheat | 100 | |||

| 1. Allocations of output for crop specific leases are not inclusive of the collective lease agreements. | ||||

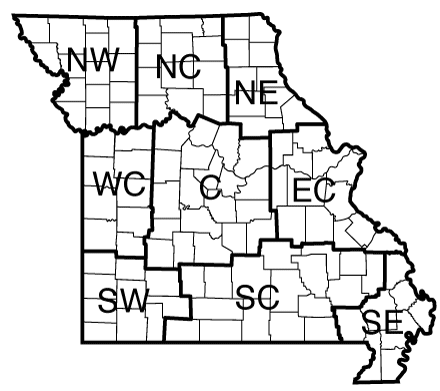

Table 1 lists the percent of respondents that reported receiving a 50 percent, 67 percent, and 75 percent tenant share. The “Other” column is the percent of respondents not using these common share agreements. The amount of output received by the tenant should be in proportion to inputs contributed and risks assumed. Crop-related government payments are generally split in the same proportion as output received. There is considerable variation in the type of sharing of output across the state. Producers in the northern and central parts of the state commonly elected to participate in 50-50 leases, with a small number of 2/3-1/3 and 75-25 leases filling out the balance. Producers in southern Missouri prefer2/3-1/3 leases, and cotton and rice growers in the bootheel also utilize 70-30 and 75-25 leases. Other common lease agreements in the “Other” column of Table 2 were 60-40 and 70-30 leases. See Figure 1 for a map of the USDA crop reporting districts used to establish the regions used in Table 2.

Input share arrangements

Economic evaluation of a crop-share agreement would suggest that variable inputs that increase production should be split in proportion to the output received. For example, in a 50-50 crop-share agreement in which insecticide is required to reduce an expected pest problem that endangers the crop, the tenant and landowner would split the insecticide costs 50-50. This is because both the landowner and tenant could increase revenue through exterminating insects. However, in reality such an arrangement depends on how the tenant and landowner specify the crop-share contract.

Summary of input shares

Table 2. Reported sharing of crop inputs under crop-share leasing by output shares.

| Output share | Landowner input share | ||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Fertilizer

|

Seed

|

Fungicide

|

Herbicide

|

Insecticide

|

Application

|

Harvest

|

Storage cost

|

Land maintenance

|

|

| All crop types | Percentage of applicable respondents reporting | ||||||||

| 50-50 | |||||||||

| Landowner pays 50% | 100 | 100 | 100 | 100 | 96 | 75 | 71 | 61 | 10 |

| Landowner pays different than 50% | 10 | ||||||||

| Landowner pays 0% | 4 | 25 | 24 | 17 | 10 | ||||

| Landowner pays 100% | 6 | 22 | 71 | ||||||

| All crop types | Percentage of applicable respondents reporting | ||||||||

| 67-33 (2/3-1/3) | |||||||||

| Landowner pays 33% | 100 | 50 | 92 | 75 | 93 | 83 | 60 | 25 | |

| Landowner pays different than 33% | 40 | ||||||||

| Landowner pays 0% | 50 | 8 | 25 | 7 | 17 | 100 | |||

| Landowner pays 100% | 75 | ||||||||

Table 2 summarizes the landowner’s share of inputs contributed for 50 percent or 33 percent (one-third) of output received. In general, for a 50-50 crop-share agreement, contributions of inputs are shared in the same proportion as output. Twenty-five percent of the respondents indicated the tenant paid all costs for fertilizer, herbicide, fungicide, and insecticide application (all of which are included under “application” in Table 3. This is probably due to the tenant having the machinery necessary to apply the inputs and not having to hire a custom applicator. For most 50-50 crop-share agreements, harvest costs are split equally. Generally, crop-share agreements for dryland and irrigated land are similar. Irrigation costs are typically shared in proportion to output share received. For the 67-33 (2/3-1/3) crop-share agreement, input costs are apportioned more heavily to the tenant than in a 50-50 agreement. However, fertilizer and lime costs are typically paid in the same proportion as output received. This is because fertilizer and lime could be considered long-term investments in the land.

Land improvements

Over 70 percent of the respondents indicated the landowner paid all of the costs of land improvement. Another 20 percent of respondents indicated that land improvement costs were split, and 10 percent indicated the tenant paid for land improvements. Because there is a long-term benefit to the land, it was not surprising that the landowner generally covered the costs of land improvement. There is little value to the tenant for paying land improvement costs only to have the landowner rent to a different tenant the following year. However, an average 18-year tenancy of the land indicates long-term expectations by both tenant and landowner.

Additional resources

For additional information regarding farm land value, leasing agreements or cash rental rates, please view the following MU Extension publications: