COLUMBIA, Mo. – As Missouri farmers and food entrepreneurs prepare for busy holiday and winter markets, a new University of Missouri Extension publication helps clarify how state sales tax laws apply to farm direct-to-consumer sales.

The guide, Missouri Farmers Market Sales Tax Exemption, explains how farm businesses can determine whether they must collect and remit state and local sales taxes, or if their sales qualify for Missouri’s farmers market sales tax exemption.

“Many producers are selling at special holiday markets right now,” said Jennifer Lutes, MU Extension field specialist in agricultural business and policy and author of the guide. “This resource helps farmers understand the details of the exemption so they can stay compliant and confident in their sales.”

Lutes adds that sales tax policies can evolve over time, and it’s important for producers to stay informed. “Because sales tax rates and policies are subject to legislative changes, we encourage farmers to verify current rates and regulations directly with the Missouri Department of Revenue before each market season,” she said. Producers can find the most up-to-date local tax rate information using the Missouri Sales and Use Tax Rate Map.

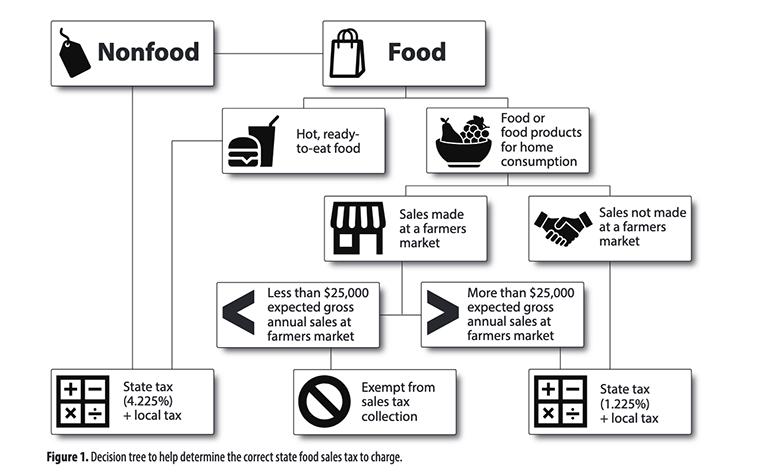

The publication outlines several key factors that determine whether sales are exempt, including where the sale occurs, who is selling the product, what products are being sold and the scale of annual market sales. It also includes examples, definitions and a decision tree that walks readers through Missouri’s sales tax rules step by step.

MU Extension extends appreciation to the Missouri Department of Revenue for reviewing the guide and contributing to the accuracy of this educational resource, Lutes said.

“Missouri Farmers Market Sales Tax Exemption” is available for free download.

MU Extension provides research-based education and resources to help Missouri farmers, agribusinesses and communities strengthen their operations, manage risk and build resilient local food systems. Learn more about MU Extension’s agricultural business programs.