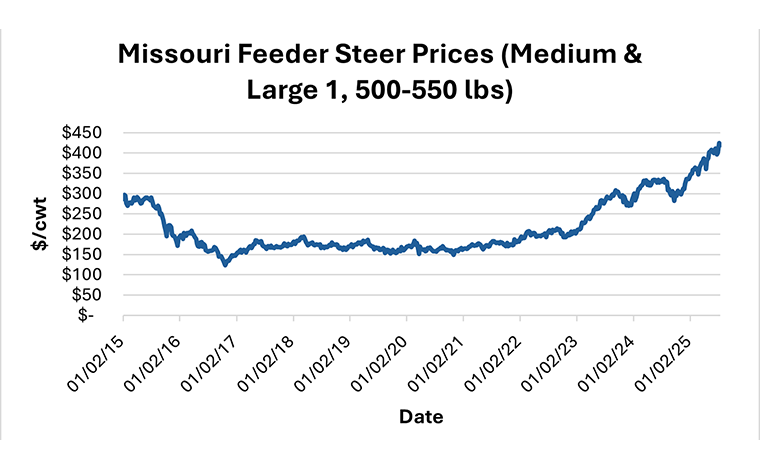

FORSYTH, Mo. – Rising cattle prices still show no signs of letting up. Recent data from the USDA Livestock, Poultry & Grain Market News report charts the continued upward trend of Missouri feeder steer prices since 2015.

“High prices typically lead to increased profits, which is good news for cattle producers,” says University of Missouri Extension agricultural business specialist Jacob Hefley. “However, this also brings something most producers would rather not think about: a higher tax bill.”

With the signing into law of the 2025 budget reconciliation bill (also known as the “One Big Beautiful Bill Act”), there are a few tax changes to note that may affect planning, says Hefley.

Bonus depreciation made permanent

Bonus depreciation allows producers to deduct a percentage of asset costs in the year the assets are placed in service. The 2017 Tax Cuts and Jobs Act (TCJA) introduced 100% bonus depreciation, which has been gradually phasing out. It was originally set to fully phase out by 2027, with the 2025 level capped at 40%. However, the 2025 budget reconciliation bill allows 100% bonus depreciation permanently for property acquired after Jan. 19, 2025. Producers anticipating high profits this year and beyond can use bonus depreciation to offset income and reduce their tax burden. It’s important to note that bonus depreciation is applied automatically unless a taxpayer opts out.

Increased Section 179 expensing limits

Similar to bonus depreciation, Section 179 allows producers to expense the full cost of qualifying asset purchases in the year they are placed in service. However, Section 179 must be elected and is subject to limits. Under new legislation, the annual Section 179 deduction limit has increased to $2.5 million, up from $1.22 million for the 2024 tax year. Additionally, the investment limit—the maximum total of property that can be considered—has increased from $3.05 million to $4 million. This means that if more than $4 million in qualifying property is placed in service in a single year, the deduction is reduced dollar for dollar by the excess amount. “The deduction and investment limit amounts will be indexed for inflation after 2025,” Hefley says. “While many producers may not be affected by these thresholds, the increased limits could have implications for large operations or in years with unusually high asset purchases.”

Section 199A deduction extended indefinitely

Another major change is the extension of the Section 199A Qualified Business Income deduction. Created by the TCJA, Section 199A allows owners of “pass-through” businesses—such as sole proprietorships, partnerships and LLCs—to deduct up to 20% of their qualified business income on their federal tax returns. Originally set to expire in 2025, this deduction has now been extended indefinitely. If you qualify, and many producers do, this could continue to lower your personal taxes for years to come, Hefley says.

“The tax provisions outlined here cover only part of the new policy changes that may affect you,” he says. “Even within the topics discussed—bonus depreciation, Section 179 and Section 199A—other rules and limits may apply depending on your operation. Many factors, such as market trends, input cost changes, and shifts in production, can also affect the best tax strategy for you. Work with a qualified tax adviser to understand how the new law may apply to your farm.”

For more information, find the MU Extension agricultural business specialist in your area.

Graph

Mo. Feeder Steer Prices

Missouri feeder steer prices (Medium & Large 1, 500-550 lbs.). Source: USDA AMS Livestock, Poultry & Grain Market News.