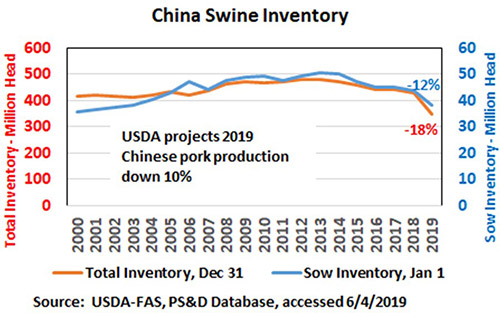

The U.S. Department of Agriculture (USDA) projects that by the end of 2019, China’s total swine inventory will be down by 18%. Indeed, the USDA estimated that the Chinese sow inventory was down 12% at the start of 2019.

China's Ministry of Agriculture reported that as of April 2019, the swine breeding herd inventory was down 22%. China is currently encouraging its provincial authorities to provide subsidies to large-scale farms that produce greater than 5,000 hogs per year. These subsidies are expected to include credit guarantees, loan interest rates of 2 percent as well as paperwork simplification and shorter loan processing times.

Even if the ASF outbreaks are under control, biological lags in the swine production process will slow how quickly breeding herds recover. Reduced pork production will stimulate continued interest in pork imports (at least for the next few years), while reducing the short term need for soybeans. Depending on the level of China’s retaliatory tariffs on pork and other meats, there may be opportunities for increased U.S. meat exports to China. With the tariffs in place in 2018, the value of U.S. pork exports was down 14 percent, but the value of beef and poultry exports were up 96% and 32%, respectively.

Writer: John Kruse