MARSHALL, Mo. – A growing number of businesses that have nothing to do with offering loans are looking at consumer credit history.

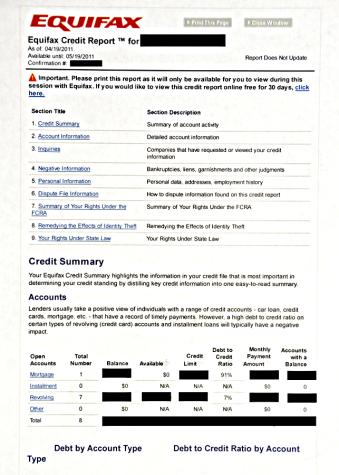

“People tend to underestimate just how important this document is to them,” said Cynthia Crawford, family financial education specialist for University of Missouri Extension.

Potential employers will screen an applicant’s credit history when making hiring decisions. A black spot on a credit report can also undermine success in renting an apartment from many landlords.

Property insurers use credit reports to justify higher premiums and auto insurance companies see bad credit history as a risk for filing auto claims.

However, consumers can restrict access to their credit report.

“I found that I could make a request to the credit bureau that they limit access to my credit file,” Crawford said. “There are different levels of access and I chose to have the strictest one, which says unless I give written permission, a company cannot be looking in my credit report.”

You can apply online at Opt Out Pre Screen. This will prevent consumer credit reporting companies from providing your information to credit or insurance companies. An online request is good for five years. If you mail the “opt-out” form, it will permanently block unauthorized access to your credit file.

“A side benefit is I get fewer offers for credit because they cannot just freely look at my credit report,” Crawford said. “I like that.”

There is a third option called a security freeze, which will stop all access to your credit history, according to Consumers Union. If you are a victim of identity theft, this service is free. Others pay a fee that varies from state to state. More information on this service is available from Consumers Union.

“Many people are like me and consider their finances to be a very private aspect of their lives,” Crawford said. “Be proactive and keep your financial information from prying eyes.”

Writer: Debbie Johnson