Executive summary

Federal contracting is an important generator of economic activity — not only in places like Washington, DC — but also throughout the country in states such as Connecticut, New Mexico and Missouri. Private firms of all sizes provide the products, equipment and services that the federal government needs to function. These federal contracts support many jobs, and create business and growth opportunities for additional firms through sub-contracting opportunities. This brief draws upon ten years of contracting data from the USAspending.gov database to describe the nature and extent of federal contracting activities performed in Missouri to answer several basic questions, including:

- How many contracting dollars does Missouri receive, relative to other states,

- What federal agencies spend the most money in Missouri,

- Which Missouri-based companies receive the most federal contracting dollars,

- In what activities are these companies involved,

- How do federal contracting patterns vary throughout the state,

- To what extent does federal contracting benefit small, veteran, minority- or women-owned businesses, and

- What level of sub-contracting activity occurs in Missouri.

In the federal Fiscal Year (FY) 2019, Missouri-based firms received $15.1 billion in prime federal contracts and another almost $3 billion in sub-contract awards. To place this contracting activity into context, these contracts represented 5.4% of Missouri’s 2019 GDP ($332 billion). Overall this placed Missouri 8th amongst states in terms of total (prime and sub-contracts) federal contracting as a share of total state GDP.

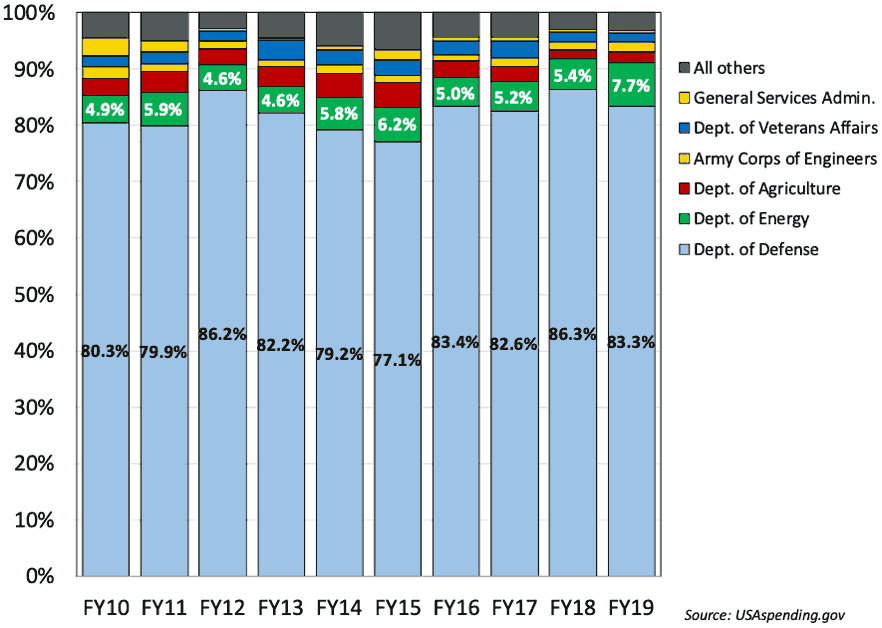

Over the past decade, the U.S. Department of Defense (DOD) has been the primary source of federal contract dollars. Department of Defense contracts were the source of 83.3% — $12.5 billion — of the prime federal contract dollars in Missouri. Other agencies granting contract significant contracts performed in Missouri include the U.S. Department of Energy, the U.S. Department of Agriculture, the U.S. Army Corps of Engineers, and the U.S. Veterans Administration. Overall, 42 federal agencies had contracts performed by Missouri-based companies in FY 2019.

While most federal contracts are awarded to small businesses, the vast majority of federal contract dollars go to a small number of very large firms that are required to utilize small businesses in the federal contract. The federal government’s contracts with the aircraft manufacturer Boeing represented more than half of all prime contracting dollars in Missouri in FY 2019. In total, Boeing’s Missouri-based operations received more than $9.25 billion in federal contracts in FY 2019 (61.7% of all prime contracts performed in Missouri). Six companies — Boeing (including McDonnell Douglas), Honeywell, Express Scripts, DRS Sustainment Systems, Alliant Techsystems Operations and World Wide Technology — have consistently been the state’s largest recipients of prime federal contracts every year for the past decade. During this time, these six companies’ share of Missouri’s prime federal contract dollars ranged anywhere from 69% to 86% of the total.

Manufacturing (NAICS 31-33) represented almost two-thirds of Missouri’s FY 2019 prime contracting dollars, led largely by Boeing’s building aircraft. Beyond manufacturing, $1.5 billion (10% of the FY 2019 total) in prime federal contracts were in administrative and waste services (NAICS 56). Construction (NAICS 23) accounted for over $950 million in prime federal contracts, or 6.4% of the FY 2019 total, and over 40% of these funds are paying for the ongoing construction of the Next NGA West facility in Saint Louis.

In FY 2019, over 95% of total (prime and sub) federal contracts went to firms located in Missouri’s metropolitan areas, and particularly to firms in the Missouri counties of the St. Louis metro area (75% of the total). This disproportionate share is due in large part to the presence of Boeing, Express Scripts, DRS Sustainment Systems and World Wide Technology Solutions in St. Louis County, as well as the aforementioned Next NGA West Facility construction. Another 12% of Missouri’s federal contracts are in Jackson County where Honeywell manages the Department of Energy’s Kansas City National Security Campus and Alliant Techsystems’ facility in Independence. Outside of Missouri’s urban centers, the impact of federal contracting is more scattered, with Missouri’s military bases attract significant federal spending relative to the size of the county.

Although large firms receive the lion’s share of prime federal contract dollars, almost 3,400 Missouri-based firms performed prime federal contracts in FY 2019. Many of these firms were veteran-, service-disabled veteran-, women-, and minority-owned businesses; businesses located in historically underutilized (HUB) zones; as well as sole proprietorships and disadvantaged businesses participating in the Small Business Administration’s (SBA) certified 8(a) business development program. These contracts demonstrate that beyond procuring the goods, equipment or services it needs to operate, this spending can also create opportunities for potentially under-utilized or disadvantaged businesses.

Many firms first engage in federal contracting through sub-contracting agreements. Although the majority of federal contracts performed in Missouri are prime contracts, sub-contract awards also generate additional economic activity in the state. The scale of sub-contracting has varied from year-to-year over the past decade. In FY 2019, $2.95 billion in federal sub-contracts were performed in Missouri and these contracts represented 16.4% of the state’s total federal contracts. Of these sub-contracts, almost $1.7 billion (57.7% of all sub-contracts performed in Missouri) had out-of-state prime contractors. Most of these subcontracts supported manufacturing activities in the defense and aerospace industry.

The biggest challenge facing many firms interested in securing federal contracts is getting started and then securing that first contract. These difficulties arise because federal contracting comes with several unique challenges that sets it apart from more typical private sector business activities. The bidding processes and regulations often associated with these activities can prove frustrating for companies that are lacking the experience with securing federally-funded contracts. As a result, sub-contracting to a current prime contractor is often the best solution for building the required past performance necessary to win federal contracts. To overcome these challenges, the Missouri Apex Accelerator offers counseling and support to Missouri-based companies in order to help them identify federal contracting opportunities and then take advantage of those opportunities.

Federal contracting trends in Missouri

In many parts of the country, federal contracting is an important generator of economic activity. Private sector firms of all sizes provide the products, equipment and services that the federal government needs to function. These contracts support many jobs, and create business and growth opportunities for additional firms through subcontracting opportunities. As the home of the U.S. federal government, the National Capital Region (Washington, DC; Northern Virginia; and parts of Maryland) is rightly viewed as the center for contracting activity. However, in FY 2019 over 80% of all federal contracting dollars supported activities performed outside of Virginia, Maryland, and the District of Columbia. As a result, federal contracting supports a wide array of economic activity in states and regions across the country, including Missouri.

This brief draws upon ten years of contracting data from the USAspending.gov database to describe the nature and extent of federal contracting activities performed in Missouri. This database allows the public to see how the federal government spends public money. This analysis examines both prime contracts and sub-contracts1 based upon where the contractor performs this work. Although not all of these funds are spent in Missouri (e.g., Boeing draws on a national supply chain), the focus on place of performance allows us to understand where the majority of this federally contracted work takes place. Therefore, the USAspending.gov data allows us to answer several basic questions, including:

- How many contracting dollars does Missouri receive, relative to other states,

- What federal agencies spend the most money in Missouri,

- Which Missouri-based companies receive the most federal contracting dollars,

- In what activities are these companies involved,

- How does the level of federal contracting vary throughout the state,

- To what extent does federal contracting benefit small, veteran, minority- or women-owned businesses, and

- What level of sub-contracting activity occurs in Missouri?

For each of these questions we primarily draw upon contracting data for the federal Fiscal Year 20192 (October 1, 2018 through September 30, 2019), and in some instances we include more historical trends over the past decade (FY 2010 to FY 2019). Combined, these data effectively describe the nature and extent of federal contracting in Missouri.

In FY 2019, Missouri-based firms received almost $18 billion in federal contracts

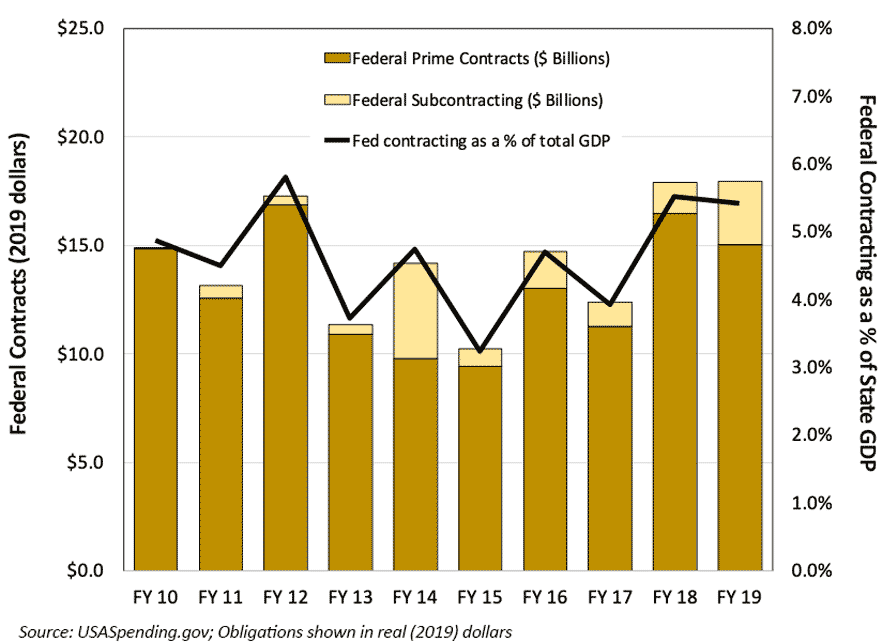

In FY 2019, Missouri-based firms received $15.1 billion in prime federal contracts, and another almost $3 billion in sub-contract awards. Figure 1 shows that over the past decade, the total value of federal contracts received by Missouri-based businesses fluctuated. In FY 2012, 2018 and 2019 Missouri received in excess of $17 billion, but total federal contracts in Missouri were just over $10 billion in FY 2015.

Figure 1. Federal contracting dollars in Missouri (FY 2010–FY 2019).

Some of these contract dollars leave the state through sub-contracts (and Missouri-based sub-contractors support out-of-state primes), but overall Missouri receives a significant amount of federal contracting dollars relative to other states. Among the 50 states and District of Columbia, Missouri received the 12th largest amount of federal contract dollars (prime and sub-contracts) and had the 9th largest amount of prime federal contract dollars per capita ($2,940 per person).

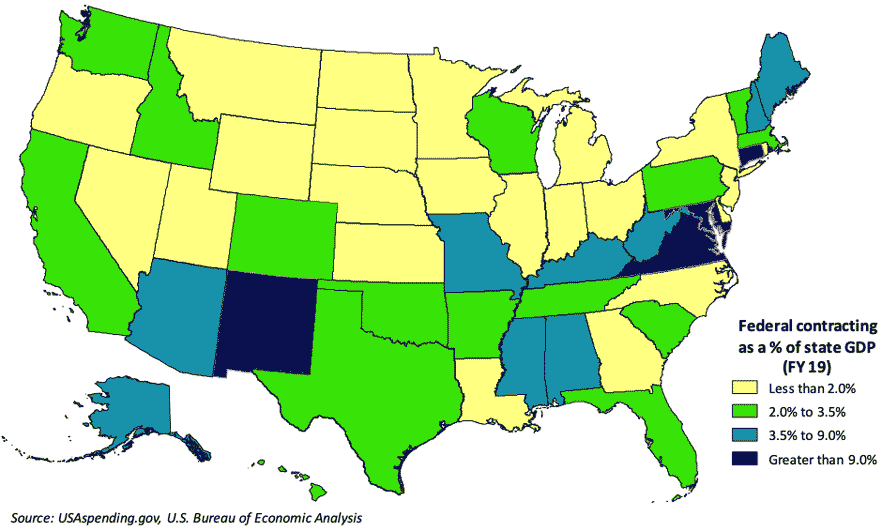

Another way to contextualize this contracting activity is to compare the value of these contracts to the state’s Gross Domestic Product (the total value of goods and services produced in Missouri). Figure 2 shows that in FY 2019, Missouri was 8th amongst states in terms of total (prime and sub-contracts) federal contracting as a share of total state GDP. Combined, these contracts represented 5.4% of Missouri’s 2019 GDP ($332 billion). Consequently there are other places that receive more federal contracting dollars and where those contracts represent a larger share of the state economy, but Missouri nevertheless benefits relatively more than many other states.

Figure 2. Federal contracting as % of state GDP.

With over $105.5 billion in total federal contracts, California received more federal contracting dollars in FY 2019 than any other state. However, California has the nation’s largest economy and the value of these contracts represented just over 3% of its economy. By contrast, total federal contracting makes the greatest relative contributions to state GDP in the National Capital Region (17.4% in DC, 10.2% in Maryland, 13.2% in Virginia), as well as in smaller states that receive significant amounts of federal spending (e.g., National Labs in New Mexico, Groton Shipyards in Connecticut).

The U.S. Department of Defense accounts for the vast majority of Missouri’s federal prime contracts

Over the past decade, the U.S. Department of Defense (DOD) has been the primary source of federal contract dollars. Figure 3 shows that in FY 2019, DOD was the source of 83.3% — $12.5 billion — of the prime federal contract dollars in Missouri. Boeing’s contracts with the U.S. Air Force and U.S. Navy account for a large proportion of these contracts. Other significant sources of federal contracting include Express Scripts’ contracts with the Defense Health Agency and the multiple contracts funded by the Defense Logistics Agency, that in part support operations at Fort Leonard Wood and Whiteman Air Force Base.

Figure 3. Agency share of prime federal contracting in Missouri.

Figure 4 shows the other agencies and sub-agencies that represent the remaining sources of prime contracts performed in Missouri in FY 2019. These agencies include:

- The U.S. Department of Energy was responsible for $1.16 billion in prime contracts within State of Missouri. These contracts largely supported Honeywell’s management of DoE’s Kansas City National Security Campus.

- A variety of federal agencies within The U.S. Department of Agriculture (USDA) funded almost $283 million in prime contracts during FY 2019. These agencies included USDA’s Office of the Chief Information Officer, the Farm Production and Conservation Business Center, and the Farm Service Agency. Much of these contracts are designed to support USDA’s activities — primarily in the Kansas City metro area — through the provision of, for instance, information technology services and equipment.

- The U.S. Army Corps of Engineers granted almost $280 million in prime federal contracts in Missouri in FY 2019. Most of these federal contracts supported the construction, repair and/or alteration of physical infrastructure (e.g., levees), and for the provision of engineering services.

- In FY 2019, the U.S. Department of Veterans Affairs had over $221 million in prime federal contracts, largely to support the VA hospitals throughout the state. As a result, these contracts resulted in the purchase of medical and surgical instruments, equipment and supplies, as well as the services like maintenance and cleaning services necessary to operate these facilities.

- The General Services Administration (GSA) was responsible for just over $90 million in federal prime contracts performed in the State of Missouri. There are approximately 56,000 federal employees throughout the State of Missouri; 19,500 in the Missouri counties of the Kansas City metro area and 17,250 in the Missouri counties of the St. Louis metro area.3 The GSA contracts primarily support this federal presence through, for instance, the acquisition of office supplies and furniture, housekeeping and information technology services, and building repair and maintenance.

Although these agencies were the source of most federal contract spending in Missouri, overall 42 federal agencies had contracts performed in the State of Missouri in FY 2019.

Figure 4. Total federal action obligation in Missouri by agency (FY 2019).

| Agency/Sub-Agency | Total Federal Action Obligation |

|---|---|

| Department of Defense (DOD) | $12,508,802,992 |

| Dept of the Air Force | $4,885,017,380 |

| Dept of the Navy | $4,441,423,399 |

| Dept of the Army | $1,815,970,843 |

| Defense Health Agency (DHA) | $649,832,321 |

| Defense Logistics Agency | $604,133,516 |

| Defense Information Systems Agency (DISA) | $59,058,762 |

| Dept of Defense | $38,898,606 |

| Defense Advanced Research Projects Agency (DARPA) | $4,600,042 |

| U.S. Special Operations Command (USSOCOM) | $4,117,723 |

| Defense Threat Reduction Agency (DTRA) | $3,510,119 |

| Defense Commissary Agency (DECA) | $1,982,887 |

| Department of Energy (DOE) | $1,159,888,856 |

| Department of Agriculture (USDA) | $282,907,466 |

| USDA, Office of the Chief Information Officer | $65,915,114 |

| Farm Production and Conservation Business Center | $57,392,537 |

| Farm Service Agency | $55,911,277 |

| Rural Housing Service | $24,118,607 |

| USDA, Departmental Administration | $23,121,931 |

| Agricultural Marketing Service | $13,758,511 |

| Natural Resources Conservation Service | $9,695,894 |

| Forest Service | $8,446,379 |

| Agriculture, Department of | $7,949,651 |

| Food and Nutrition Service | $6,918,877 |

| Animal and Plant Health Inspection Service | $4,385,765 |

| Foreign Agricultural Service | $2,321,907 |

| Corps of Engineers – Civil Works (USACE) | $279,748,938 |

| Department of Veterans Affairs (VA) | $221,015,562 |

| General Services Administration (GSA) | $90,190,013 |

| Public Buildings Service | $43,735,350 |

| Federal Acquisition Service | $29,634,168 |

| Office of the Chief Information Officer | $14,777,021 |

| General Services Administration | $1,281,997 |

| Source: USAspending.gov | |

Boeing contracts represented more than half of the state’s prime contracting dollars

Although small firms receive the greatest number of federal contracts, larger firms receive the vast majority of the funding. Several large companies dominate federal contracting in Missouri, and none more than the aircraft manufacturer Boeing. Over the past decade, more than half of all prime federal contracting dollars in Missouri went to Boeing. In recent years, there have been times where the scale of activities at Boeing’s facility in St. Louis County looked uncertain. Boeing manufacturers the F/A-18 Hornet for the U.S. Navy in its St. Louis facility, and that contract was not only expiring but the fighter jet market appeared to be shifting toward Lockheed Martin’s F-35.4 However, increased foreign sales of the F/A-18 Hornet, and winning the contracts to build the U.S. Air Force’s new training jet (the T/X Trainer) and the MQ-25A Stingray (the Navy’s first unmanned aerial refueling drone) has led to an increase in activity at the Boeing’s St. Louis area facilities.

Figure 5 shows that in FY 2019, Boeing’s Missouri-based operations received more than $9.25 billion in federal contracts — a figure almost double what Boeing received in FY 2014 and FY 2015. In FY 2019, Boeing accounted for 61.7% of all federal contracts in Missouri, and as a result it makes significant contributions to the St. Louis and Missouri economies. To put this in context, these contracts represent 2.8% of Missouri’s 2019 GDP.

Figure 5. Total prime federal contract dollars by company in Missouri (FY 2019).

|

Prime Contract Recipient |

FY 19 Federal Obligation | % of Total |

|---|---|---|

| Boeing (including MD) | $9,259,831,008 | 61.7% |

| Honeywell | $1,215,231,292 | 8.1% |

| Express Scripts | $637,801,670 | 4.2% |

| DRS Sustainment Systems | $463,619,621 | 3.1% |

| McCarthy Hitt-Next NGA West JV | $407,965,869 | 2.7% |

| Alliant Techsystems Operations LLC | $318,603,059 | 2.1% |

| World Wide Technology | $306,257,695 | 2.0% |

| Total Contracts | $15,011,625,476 | 100.0% |

| Source: USAspending.gov | ||

In addition to Boeing, several other companies receive a significant share of prime federal contracting dollars in Missouri. In FY 2019, these firms included:

- Honeywell manages the DoE’s Kansas City National Security Campus, which produces the vast majority of the nonnuclear material used in the U.S. nuclear weapon arsenal.

- Express Scripts is a St. Louis-based pharmacy benefit management organization that administers the Department of Defense’s TRICARE pharmacy program.

- DRS Sustainment Systems manufacturers military equipment at facilities in St. Louis and West Plains.

- McCarthy HITT-Next NGA West JV is a partnership of St. Louis-based McCarthy Building Companies and Falls Church, VA-based HITT Contracting to build the Next NGA West campus for the National Geospatial-Intelligence Agency in St. Louis City.

- Alliant Techsystems Operations, LLC is a subsidiary of Northrup Grumman that manufacturers ammunition in Independence, MO.

- World Wide Technology Solutions provides information technology and telecommunications systems, support and equipment for a variety of federal agencies primarily for DOD, but also USDA and DOE. It is based in Maryland Heights in St. Louis County.

These companies have consistently been Missouri’s leading recipients of prime federal contacts. With the exception of firms involved in construction-related projects (e.g., McCarthy Hitt Next NGA West JV), these six companies — Boeing (including McDonnell Douglas), Honeywell, Express Scripts, DRS Sustainment Systems, Alliant Techsystems Operations and World Wide Technology — have been the state’s six largest recipients of prime federal contracts every year for the past decade. During this time, these six companies’ share of Missouri’s prime federal contract dollars ranged anywhere from 69% to 86% of the total.

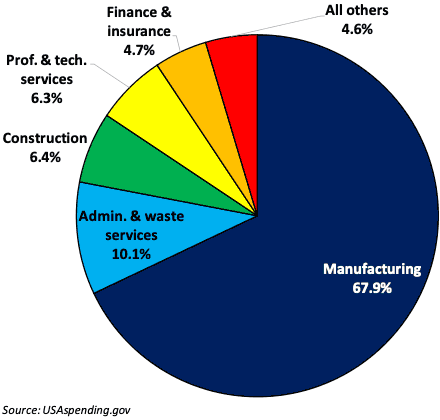

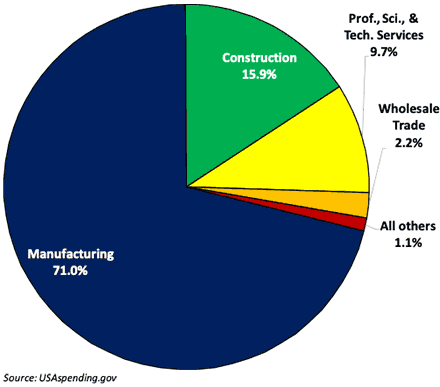

Missouri-based manufacturers receive two-thirds of federal prime contracting dollars

Figure 6 shows that manufacturing (NAICS 31-33) represents almost two-thirds of Missouri’s FY 2019 prime contracting dollars. In total $10.2 billion went to manufacturers; 72% of that $10.2 billion went to prime contractors involved in transportation equipment manufacturing (NAICS 336, which includes Boeing). Another $1.5 billion in prime federal contracts went to fabricated metal manufactures (NAICS 332) and Missouri-based computer and electronic equipment manufacturers (NAICS 334) received almost $925 million.

Figure 6. Total federal action obligation in Missouri by NAICS industry (FY 2019).

Figure 6. Total federal action obligation in Missouri by NAICS industry (FY 2019).

Beyond manufacturing, $1.5 billion (10% of the FY 2019 total) in prime federal contracts were in administrative and waste services (NAICS 56); Honeywell was the largest firm in this industry as it received approximately $1.2 billion to manage DoE’s Kansas City National Security Campus. Missouri-based firms engaged in professional and technical services (NAICS 54) and finance and insurance (NAICS 52) were awarded $945 million and $709 million in prime federal contracts, respectively.

Construction (NAICS 23) accounted for over $950 million in prime federal contracts, or 6.4% of the FY 2019 total, and over 40% of these funds supported the construction of the Next NGA West facility in Saint Louis. Other FY 2019 construction-related contracts paid for levee construction and repair in northwest Missouri, as well as building construction and maintenance to support the federal presence in Kansas City and St. Louis, as well as activities around Fort Leonard Wood and Whiteman Air Force Base.

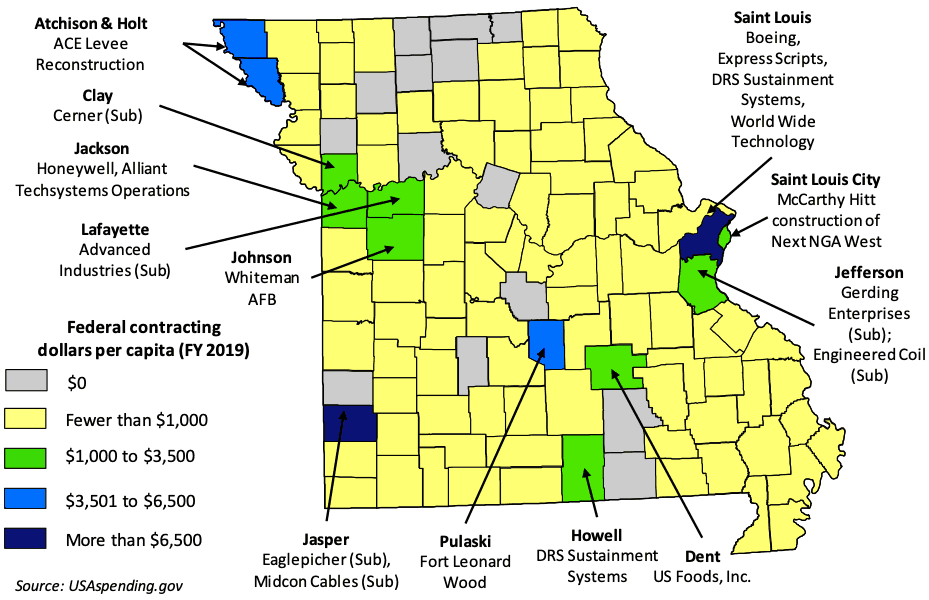

Most federal contracts go to firms based in the state’s more urban areas

Over 95% of total (prime and sub) federal contracts go to firms located in Missouri’s metropolitan areas.

- Almost 75% of Missouri’s total federal contract dollars are performed in the Missouri counties of the St. Louis metro area. This disproportionate share is due in large part to the presence of Boeing, Express Scripts, DRS Sustainment Systems and World Wide Technology Solutions in St. Louis County, as well as the construction of the Next NGA West Facility in St. Louis City.

- Another 12% of Missouri’s federal contracts are in Jackson County where Honeywell manages the Department of Energy’s Kansas City National Security Campus and Alliant Techsystems’ facility in Independence.

Figure 7 shows per capita federal contracting dollars, and as a result the relative impact of that spending. Outside of Missouri’s urban centers, the impact of federal contracting is more scattered. Not surprisingly, Missouri’s military bases attract significant federal spending, particularly relative to the size of their communities.

Figure 7. Per capita federal contracting dollars (FY 2019).

- In FY 2019 there was more than $331 million in federal contracts in Pulaski County, predominantly in support of the activities at Fort Leonard Wood. On a per capita basis, this represents about $6,300 per resident of Pulaski County.

- In Johnson County (home of Whiteman Air Force Base) there was $138 million in federal contracts, or $2,550 per resident.

In more rural counties, high per capital federal contract spending follows two patterns.

- First, there may be a prominent federal contractor in a relatively rural county. For instance, Howell County received over $55 million in federal contracts in FY 2019 and almost all of that was the result of DRS Sustainment Systems manufacturing heavy equipment in West Plains for the U.S. Department of Defense. Similarly, Dent County received $28 million in federal contracts. Almost all of that spending was the result of the Defense Logistics Agency contracting with U.S. Foods to provide a variety of different food products.

- The other pattern that emerges is one where federal contracting occurs more irregularly. For instance, in FY 2019 there was a combined $47 million in Army Corps of Engineers contracts in Atchison and Holt Counties to support the construction and reconstruction of levees after flood damage. Similar spending occurred in these counties in FY 2012.

In a number of other counties, much of the federal contracting activity was the result of several relatively large sub-contracts (Sub-contracts are discussed in greater detail below).

- There is significant federal contracting in Jasper County, due to EaglePicher Technologies’ subcontract with companies like Raytheon and Lockheed Martin. In FY 2019, EaglePicher had approximately $950 million in federal sub-contracts to manufacture batteries for the defense, aviation and medical device industries. Eaglepicher’s batteries help power the International Space Station and Mars Rovers.

- Other notable sub-contracts for Missouri-based defense and aerospace companies are found throughout the St. Louis metro area. For instance, in FY 2019 Boeing had sub-contracts with aerospace parts manufacturers in Jefferson (e.g., Gerding Enterprises), St. Charles (e.g., Patriot Machine, and St. Louis (e.g., GKN Aerospace) counties. Outside of Kansas City, Advanced Industries makes aluminum containers for Lockheed, Boeing and BAE in Lafayette County.

- Construction is another activity that generates significant sub-contracting activity. For instance, McCarthy Hitt-Next NGA West JV has the construction of the new NGA West facility in St. Louis City. Construction on this facility has begun, and the facility is scheduled to be fully operational in 2025. Through FY 2019, sub-contracts supporting this work has been awarded to St. Louis County companies such as Sachs Electric Company (electrical systems), Black & Veatch Corporation (design and construction administration), and Wilson’s Structural Steel LLC (structural steel and miscellaneous metals). Although the work is performed in St. Louis City, some of these sub-contracts are performed by out-of-state companies. For instance, Icon Mechanical Construction and Engineering is headquartered across the river in Granite City, Illinois and has been subcontracted to install HVAC systems for the new NGA West facility. It is important to note, however, that construction and subcontracting opportunities pertaining to building this facility are ongoing. Many of the subcontracting opportunities that are not yet assigned (i.e., shades, lighting, audio, visual, etc.) will be sub-contracts for smaller businesses and sole proprietorships based in St. Louis.

Federal contracting creates opportunities for a variety of firms

Large firms receive a significant majority of prime federal contract dollars, but 3,387 Missouri based firms received prime federal contracts in FY 2019. Many firms first engage in federal contracting through sub-contracting agreements (discussed in the next section), but federal contracting can nevertheless support business with different federal designations or ownership types. Figure 8 shows information about the prime federal contracts that went to veteran-, service-disabled veteran-5, women-, and minority-owned businesses, businesses located in historically underutilized (HUB) zones6, as well as sole proprietorships7 and disadvantaged businesses participating in the Small Business Administration’s (SBA) certified 8(a)8 business development program.

Figure 8. Federal contracting by firm type in Missouri (FY 2019).

| Data | Veteran-owned businesses | Service disabled, veteran-owned businesses | Woman-owned businesses | Minority-owned businesses | HUB Zone businesses | Sole proprietorships | Certified 8a participants |

|---|---|---|---|---|---|---|---|

| Number of Firms | 527 | 351 | 574 | 485 | 116 | 431 | 212 |

| Number of Awards | 1,964 | 1,256 | 5,620 | 4,770 | 380 | 4,029 | 957 |

| Value of Awards (FY 19) | $242,355,822 | $174,092,595 | $267,245,487 | $816,823,309 | $83,443,728 | $56,258,682 | $289,357,158 |

| Share of Total Awards | 1.6% | 1.2% | 1.8% | 5.4% | 0.6% | 0.4% | 1.9% |

| Average Award Size | $123,399 | $138,609 | $47,553 | $171,242 | $219,589 | $13,963 | $302,359 |

| Median Award Size | $12,976 | $16,065 | $537 | $2,781 | $24,024 | $1,624 | $15,317 |

| Agencies as share of total contract value | VA (46.2%); DOD (19.5%); USDA (12.1%); GSA (6.3%); DOL (5.5%) | VA (55.6%); DOD (17.2%); USDA (13.0%) | DOD (26.5%); DHS (24.1%); USDA (21.5%); USACE (12.8%) | DOD (63.3%); DHS (12.2%); USDA (7.6%); USACE (6.4%) | DOD (42.0%); USDA (21.1%); USACE (14.6%); VA (10.2%) | DOD (68.5%); USDA (6.3%) | DOD (50.9%); USDA (22.0%); DHS (10.7%); USACE (6.1%) |

| Industries as share of total contract value | Constr. (37.8%); Prof., Sci., & Tech Svcs. (21.0%); MFG (16.2%) | Constr. (48.4%); Prof., Sci., & Tech Svcs. (28.5%); Admin & Waste Services (9.9%); MFG (8.9%) | Prof., Sci., & Tech Svcs. (36.3%); Admin & Waste Services (32.6%); Constr. (11.0%) | MFG (26.7%); Prof., Sci., & Tech Svcs. (25.3%); Admin & Waste Services (18.7%); Constr. (15.0%) | Prof., Sci., & Tech Svcs. (36.0%); Constr. (35.2%); MFG (17.6%); Admin & Waste Services (8.5%) | Wholesale Trade (55.0%), MFG (13.8%); Healthcare & Social Assistance (10.8%) | Prof., Sci., & Tech Svcs. (36.1%); Admin & Waste Services (27.7%); Constr. (25.2%) |

| Source: USAspending.gov | |||||||

- Veteran-owned businesses: In FY 2019, 1,964 prime federal contracts went to 527 veteran-owned businesses. These contracts totaled over $242 million, or 1.6 percent of all prime federal contracts performed in Missouri. The average contract size was over $123,000 and the median was almost $13,000. Reflecting a continued connection to the military, the Veterans Administration was responsible for almost half (46.2%) of the value of contracts to veteran-owned businesses, followed by the Department of Defense (19.5%). Almost $2 out of every $5 prime contract dollars to veteran-owned businesses went toward firms in the construction industry; over 20% of these contract dollars went to firms providing professional, scientific and technical services.

- Service-disabled, veteran-owned small businesses (SDVOSBs): Roughly 350 Missouri-based SDVOSBs received 1,256 contracts in in FY 2019. The total value of these contracts was $174 million, or 1.2% of all prime federal contracts received in the state in FY 2019. In aggregate, these businesses mirror many of the same trends as veteran-owned businesses. The Veterans Administration is the leading source of contract dollars for SDVOSBs (55.8%), and these contracts primarily pay for construction-related activities and professional, scientific and technical services.

- Women-owned businesses: Among these types of businesses, women-owned businesses received the most prime federal contracts (5,620). Combined, these contracts totaled $267 million or 1.8% of all prime federal contracting performed in Missouri in FY 2019. The average contract size was $47,550 and the median was roughly $540 — the smallest among these types of businesses with different federal designations or ownership types. Women-owned businesses in Missouri were awarded contracts from a balanced set of agencies including the Department of Defense (26.5%), Department of Homeland Security (24.1%), and USDA (21.5%). A majority of the prime contract dollars went to women-owned businesses involved in professional, scientific and technical services (36.3%) and administrative and waste services (32.6%).

- Minority-owned businesses: In FY 2019, 485 minority-owned businesses received 4,770 prime federal contracts to be performed in Missouri. These contracts were worth $816 million, representing 5.4% of Missouri’s FY 2019 prime contracts. The average prime federal contract size for minority-owned business was $171,000, and much of this is due to the $306 million (37.5% of FY 2019 contracts to minority-owned businesses) awarded to World Wide Technology — one of Missouri’s largest federal contractors. The Department of Defense was the largest source of contract dollars to World Wide Technology as well as to minority-owned businesses generally (63.3%). Approximately a quarter of contract dollars to minority-owned businesses were for businesses involved in either manufacturing (26.7%) or professional, scientific and technical services (25.3%).

- Businesses located in Historically Underutilized Business Zones (HUBZones): Compared to the other types of businesses with different federal designations or ownership types, relatively fewer HUBZone businesses received prime federal contracts. In FY 2019, 116 Missouri-based HUBZone businesses received 380 awards totaling over $83 million dollars. The average award was almost $220,000 and the median was $24,000, the latter of which is relatively large among these kinds of federally certified businesses. Over two-fifths of the contract dollars were for DOD projects, and another fifth were from USDA contracts. Most of the contract dollars paid went to businesses in the professional, technical and scientific services (36.0%) or construction (35.2%) sectors.

- Sole proprietorships: Approximately 430 sole proprietorships received over 4,000 awards in FY 2019. The average value of contracts (almost $14,000) and total prime contract dollars ($56.3 million) was relatively small among sole proprietors. In total, sole proprietors received only 0.4% of the total FY 2019 prime federal contract spending in Missouri. More than two-thirds of these contract dollars came from the Department of Defense, and a majority (55%) of sole proprietors were involved in Wholesale Trade.

- SBA-certified 8(a) businesses: In FY 2019, 212 8(a) businesses received 957 contracts. However, these contracts totaled $289.4 million representing 1.9% of all prime federal contracts in Missouri. The average contract was approximately $302,400, although the median contract was significantly smaller ($15,320). The U.S. Department of Defense was the source of over half (50.9%) of the federal contract dollars to Missouri’s 8(a) business; USDA was the source of 22% of these contract dollars. These 8(a) businesses were primarily involved in one of three industries — professional, scientific and technical services (36.1%), administrative and waste services (27.7%), or construction (25.2%).

It is important to note that these types of businesses are not mutually exclusive categories as businesses can be both a veteran- and minority-owned business, for instance. There is also a mix of big firms and small firms, but as demonstrated by the large gap between the average and median-sized contracts, the most contracts go to small firms but the most funding goes to larger businesses. However, these contracts demonstrate that beyond procuring the goods, equipment or services it needs to operate, this spending can also create opportunities for potentially under-utilized or disadvantaged businesses.

Federal contracting also drives economic activity through subcontract awards

Although the majority of federal contracts performed in Missouri are prime contracts, subcontract awards also generate additional economic activity. In FY 2019, $2.95 billion in federal sub-contracts were performed in Missouri; this represents 16.4% of the state’s total federal contracts. The scale of subcontracting activity varies from year to year. Over the past decade it is has been as much as 32.8% in FY 2014, and less than 1 percent as in FY 2010. The prime contractors are not always Missouri-based companies. In FY 2019, almost $1.7 billion (57.7%) of the $2.95 billion in federal contracts performed in Missouri had out-of-state prime contractors.

Similar to the prime contracts, the sub-contracts performed in Missouri were overwhelmingly funded — 96% of the total — by the U.S. Department of Defense. Figure 9 shows that most subcontracting dollars went primarily to manufacturing firms (NAICS 31-33), as well as firms engaged in Construction (NAICS 23) and Professional and Technical Services (NAICS 54).

Figure 9. Subcontracting in Missouri by NAICS industry (FY 2019).

Figure 9. Subcontracting in Missouri by NAICS industry (FY 2019).

- Manufacturers accounted for 71% of all subcontracting dollars in Missouri. Most of this funding supported manufacturing related to the defense and aerospace industries. In some instances, these subcontractors involved working for Boeing, as in the case of Gerding Enterprises in Jefferson County (whose $631 million in sub-contracts accounted for 21 percent of all subcontracting dollars in Missouri). In other instances, Missouri-based sub-contractors worked for other defense contractors. For instance, Joplin-based EaglePicher Technologies received almost $950 million in sub-contracts in FY 2019 (representing 32.2 percent of the total value of sub-contracts in Missouri) and much of this work was done for Raytheon. Midcon Cables (also of Joplin) received $75 million in sub-contracts from Northrup Grumman in FY 2019.

- Construction-related activities represented almost 16% all federal subcontract dollars performed in Missouri. Again the Department of Defense drove most of this activity, primarily through construction spending on the new NGA West facility in St. Louis. Over 82 percent of the $467 million in construction-related sub-contracts came from McCarthy Hitt-Next NGA West JV, the prime contractor responsible for the building of that facility.

- Just under 10 percent of total sub-contracts performed in Missouri paid for professional, scientific and technical services. Cerner Corporation’s $287 million subcontract with Leidos accounted for almost half (48.3%) of all professional and technical services sub-contracts performed in Missouri. World Wide Technology — one of Missouri’s largest prime federal contractors — received another $66 million in sub-contracts which contributed to 23% of the FY 2019 sub-contracts for professional and technical services in Missouri.

Similar to prime federal contracts a significant share of contracting dollars go to a relatively small number of larger firms, but most sub-contracts go to smaller firms. Sub-contracting is important because it is often a first step for many firms — including veteran-, women-, and/or minority-owned businesses — to take advantage of the business opportunities created by the federal government.

Conclusions

Federal contracting makes important economic contributions the Missouri economy, and particularly in its urban regions. Missouri-based contractors help provide the products, services, and equipment that the federal government needs to operate. Although over 40 federal agencies have contracts performed by Missouri-based companies, the U.S. Department of Defense is the single largest source of federal contracting. Many of these contracts are awarded to manufacturers involved in the defense and aerospace industry, including both Missouri’s largest prime contractor (Boeing in St. Louis) and sub-contractor (EaglePicher Technologies in Joplin).

Federal contracting provides business opportunities for firms in a variety of industries, and many of these opportunities go to veteran-, women-, and minority-owned businesses, as well as businesses from disadvantaged communities and sole proprietors. The USAspending.gov database can help companies better understand the federal contracting landscape in Missouri, and therefore help them identify potential market opportunities. It can also help firms locate other firms already involved in government contracting, which in turn may lead to potential sub-contracting opportunities. Although this white paper focused primarily on contracting activities performed in Missouri, as noted above, almost 60% of sub-contracts performed in Missouri had out-of-state prime contractors. As a result, Missouri-based firms interested in subcontracting activities should not limit their search to just potential opportunities from Missouri-based prime contractors.

The biggest challenge facing many firms looking to enter federal contracting is getting started, and then securing that first contract. Federal contracting poses several unique challenges that sets it apart from more typical private sector business activities. The bidding processes and regulations associated with federal procurement can prove frustrating for companies that do not have experience with government contracting. To overcome these challenges, the Apex Accelerator offers mentoring and support to Missouri-based companies in order help them identify federal contracting opportunities and then take advantage of those opportunities. Located throughout the state, Apex Accelerator procurement specialists can provide the individual counseling that firms — including small, disadvantaged, women-, veteran- or minority-owned businesses — need to begin taking advantage of the market opportunities afforded by the federal government.

Footnotes

- Prime contractors are required to report information on Tier 1 sub-contracts that are greater than $25,000. Subsequent sub-contracts awarded by sub-contractors are therefore not included in the database.

- Given contract amendments or extensions, contracting data can continue to change well beyond the conclusion of the previous fiscal year. As a result, we did not include FY 2020 contracting data in this analysis as the final numbers remain fluid.

- These employment estimates were provided by Economic Modeling Specialists International (EMSI), a nationally-recognized, proprietary vendor of labor market information.

- Boeing's St. Louis plant wins major $9.2 billion contract for new Air Force training jet.

- SBA Service-Disabled Veteran-Owned Small Businesses program.

- SBA HUBZone program.

- Sole proprietorships are unincorporated businesses that are owned and run by one individual and where there is no distinction between the business and the owner.

- The Small Business Administration’s 8(a) development program is designed to help create a level playing field for level playing field for small businesses owned by socially and economically disadvantaged people or entities.