Land use agreements for wind energy can include language for a land lease, an easement, or a combination of leases and easements. These agreements are often called “wind leases” or “wind agreements,” the term used in this publication. Using research-based information, this publication provides considerations for landowners contemplating utility-scale wind energy agreements, or wind agreements.

Each lease situation is unique, and this publication does not constitute professional or legal advice. You should seek the advice of experienced and qualified professionals (e.g., attorneys, accountants) to understand how the terms and conditions of wind lease proposals could affect your farmland, farm, family and community.

Growth of wind energy

Wind energy is a form of clean, renewable energy. In the past few decades, the wind power industry has been growing in the U.S. and Missouri. Missouri’s first wind farm was established in 2007. In 2024, the state’s wind generation capacity was 2,435 megawatts (MW), or about 11% of Missouri’s electricity generation capacity, according to the U.S. Energy Information Administration.

Site suitability

When assessing potential wind farm sites, energy developers consider several factors, in particular, land requirements and wind speed.

Land requirements for wind turbines vary according to the site and equipment specifications (Figure 1). The spacing of the turbines factors in the size of the turbine, wind direction and other site considerations. Ameren’s High Prairie Renewable Energy Center in Adair and Schuyler counties has 175 turbines with a combined capacity of 400 MW across 50,000 acres.

According to the U.S. Department of Energy, in 2022 a new wind turbine was typically rated at 3.2 MW capacity with an average height of 98.1 meters. Smaller turbines tend to be older wind towers. Turbine capacity, rotor diameter and hub heights are increasing the size of wind turbines over time. Taller wind turbine towers and other wind technology advances can make wind farms feasible in locations not previously considered.

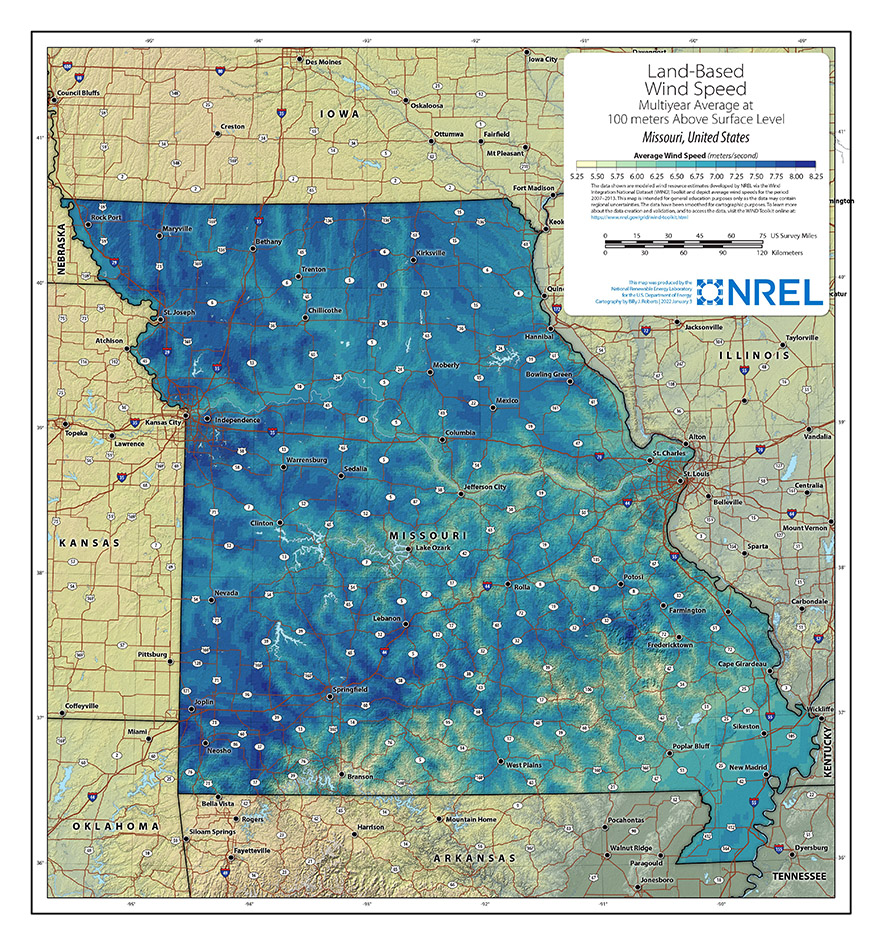

Wind speed is a key determinant of the amount of electricity a turbine can generate. Figure 2 shows Missouri average wind speeds at a 100-meter height. This figure indicates desirable locations for future wind energy development.

Economic considerations

Landowners may find wind agreements to be attractive income sources. Row crops and other agricultural production can usually continue around wind turbines, and lease payments often far exceed cash rental rates for farmland. However, signing a wind agreement has potential implications for business planning, farm financial management, and land use.

Business planning

Business planning charts long-term goals and defines strategies for meeting these goals. The process of developing a business plan helps the farm owner or operator to think about where the business has come from, where it is now, and where it is headed in the future.

Wind energy leases could impact a business plan in at least two ways. First, the wind energy lease will generate new income and expenses. Wind agreement payments and changes in the landowner’s property tax expense are two common ways a wind energy lease effects landowner income and expenses. Second, wind energy leases could potentially effect land availability and access for different business purposes. These changes and how they effect business goals can be factored into the business planning process.

Farm financial management

Payments from a wind agreement create new cash flow for the landowner. Income from the agreement usually includes annual lease and/or easement payments. In addition, the agreement could stipulate one-time payments or other compensation for the use of the land. Wind agreements in the Midwest might include these types of payments:

- Fixed payments on a per-turbine or per-megawatt basis

- Royalty or revenue-based payments, where the landowner receives a percentage of the income earned from the wind energy produced

- Combination payments that combine fixed payments with a percentage of revenues

- Wind rights payments

- One-time payments when construction begins

- Payments for access roads, transmission line siting and other land use associated with wind turbines

- Payments made even if wind turbines are not located on your property

Increased property taxes are the most common potential expense associated with wind agreements. Agreements typically stipulate that the wind turbine owner or operator is responsible for paying property taxes on the wind equipment.

Wind agreements can also limit the landowner’s ability to use land for income during wind turbine construction. Most agreements will include language compensating for such interruptions and for land disturbance and fence improvements.

A wind agreement could effect the landowner’s borrowing capacity and relationship with farm lenders. The main consideration is when the site proposed in the energy agreement is on land secured by a creditor, as in a mortgage. Creditor consent might be needed before the energy agreement is finalized.

The presence of a land use agreement could also effect the owner’s ability to use that land as collateral in future borrowing. Open communication with your lender will help you identify farm financial issues that could arise from an energy agreement.

Land impacts

Landowners may be attracted to wind agreements because turbines occupy a relatively small land footprint while offering additional revenue streams. Turbines must be widely spaced apart. Exact spacing will vary according to the project and will be based on the size and height of the wind turbine tower, and the surrounding geography. The U.S. Department of Energy estimates one to three acres of permanent land use per turbine with 25 to 125 additional acres of land needed between turbines.

Land use agreements can place different limitations on land use during and after construction of the wind turbine. Examples of common activities that could be effected by wind agreements include row crop and livestock production, and hunting and other recreational land use.

Equipment removal

A wind agreement should specify the energy company’s responsibility for removing the wind turbine and any additional equipment. Although wind agreements usually last 20 or more years, you should understand how the infrastructure will be removed and what might be required of you as the landowner at the time of removal. Inclusion of a removal bond requirement in the lease clarifies each party’s responsibilities.

Legal considerations

Many legal considerations need to be addressed when a farmland owner is considering a wind agreement.

Parts of the agreement

A land lease provides someone other than the landowner the right to possess and use the land. The lease language in a wind agreement is usually about the turbine site. The landowner receives a lease payment in exchange for letting another party use the land to construct and operate the wind turbine.

Land easements allow someone besides the landowner to use or access the land for a particular purpose. Transmission line easements and wind easements are common in wind agreements. These easements usually interfere little with farming activities. In the case of a transmission easement, the lines pass over the land. A wind easement could restrict the owner from building structures that might interfere with wind blowing across the land.

Options provide the wind company or energy developer with the right, or option, to take a defined action. Common options in wind agreements are the option to lease and/or develop the land, the option to operate on the land, and the option to extend the agreement for a certain period of time.

Title and ownership

To negotiate a wind agreement, you must have a clear or “clean” title to the land. Other parties with ownership, easements or other rights to the land could be deterrents to the wind energy developer. Mortgages, farmland leases, hunting rights, and land easements could all influence negotiations.

Joint ownership (i.e., joint tenants or tenants-in-common) of farmland is common. Joint owners may include multiple heirs of different ages with differing perspectives on how the land should be used. Joint ownership could create difficulties during negotiations with the energy developer because each legal owner must consent to the agreement.

Taxes

Wind turbines and associated equipment are taxable commercial property. Wind agreements usually specify that the wind turbine operator is responsible for paying that tax. The assessment policy of wind energy facilities in Missouri is available in the State Tax Commission’s Assessor Manual.

An accounting professional can help you determine potential income tax implications from wind agreement payments. An attorney familiar with Missouri land use, taxes and zoning laws can review the agreement to determine if it could create additional land use and tax implications.

Liability and indemnification

Wind agreements commonly address the following liability questions:

- What happens if land use laws or local zoning regulations change after wind turbines are constructed?

- What is your liability exposure from the presence of wind turbines on your land?

- Who is liable for accidents that could occur during construction and maintenance of the wind energy equipment (Figure 3)?

Other potential liability issues relating to wind energy include endangered species, especially birds and bats; nuisance complaints; and aesthetics. An attorney can help you understand who is responsible for potential liabilities under a wind agreement.

Government programs

A wind agreement will affect how leased land is treated in government programs. Consult with your local U.S. Department of Agriculture (USDA) personnel to determine possible effects a wind energy lease might have on conservation, crop and other government programs.

Property rights and land use

Energy agreements can have an impact on the landowner’s right to use the property. Common landowner concerns include prohibitions on building new structures, whether aerial pesticide applications are allowed nearby, and the use and maintenance of wind turbine access roads.

Wind agreements explicitly outline land use and what property rights the landowner grants or retains. Specific land use issues unique to your property might require further negotiations from the initial wind agreement proposal.

Social and environmental considerations

Effect on environment and neighbors

Local opposition and not-in-my-backyard (NIMBY) sentiments may deter specific projects. Opponents to utility-scale energy projects often point out how the projects could change the appearance of the local landscape and raise objections about aesthetic impacts. Opponents also raise nuisance concerns about wind turbine noise, shadows and lights.

Objections to wind energy also include environmental and wildlife concerns, especially impacts upon endangered birds and bats. Endangered species issues have affected existing and proposed Missouri wind projects.

Effect on family

Families operate most Missouri farms. Family business and succession plans should be taken into account when considering long-term impacts of a wind agreement. Different generations of the family may have different goals. Retirement and farm expansion are two areas in which disagreement frequently arise. Qualified professional advisers can help evaluate effects of changes in land use upon the family’s financial and business concerns (Figure 4).

Effect on land use

Proponents of locating wind energy in farm country point out that crop and livestock farming can carry on around wind turbines. In terms of taking farmland out of production, the potential effect of a wind turbine is much less than that of a utility-scale solar farm.

Conclusion

Wind energy has become an important electricity source in Missouri. Development of additional utility-scale wind energy farms could offer new opportunities for Missouri landowners. Landowners should have proposed wind agreements reviewed by qualified professionals to understand implications for land use, finances and liability.

Finally, farmland owners should be attentive to the potential effects of a wind lease on their community, the environment and their families.

Resources

- Land-Based Wind Market Report: 2024 Edition. U.S. Department of Energy, Office of Energy Efficiency & Renewable Energy. 2024.

- Land Use Conflicts Between Wind and Solar Renewable Energy and Agricultural Uses (PDF). The National Agricultural Law Center. 2022.

- A Landowner’s Guide to Commercial Wind Energy Contracts (PDF). Purdue Extension. 2012.

- Wind Energy Leasing Handbook. Oklahoma Cooperative Extension Service. April 2017.

The authors would like to acknowledge the legal review that Kayden Guymon, lawyer with Haden & Colbert, provided for this publication.

Original authors

Ryan Milhollin, Matt Ernst, Joe Horner