Editor’s note

This publication is also available in Spanish. (Esta publicación también está disponible en español.)

For local food producers, marketing decisions are as important as production decisions. Marketing involves developing a good that meets buyers’ needs, setting an appropriate price and promoting the product to build awareness and drive sales. However, these product, pricing and promotion decisions hinge on the market channels used to distribute products.

Multiple factors shape a producer’s choice of market channels. They include the following:

- The end consumers you want to target

- Your product’s perishability

- The product volume a market will demand

- Your production volume

- A market’s barriers to entry and expansion

- The costs required to serve a market

- The market’s price sensitivity

- Your production costs and profitability expectations

Missouri producers may consider market channels such as farmers markets, u-pick, on-farm or roadside markets, community-supported agriculture (CSA), online marketplaces, retailers, restaurants, institutions, produce auctions, cooperatives, food hubs and wholesalers and distributors. This publication summarizes features of these market channels.

Market channels as part of food product supply chains

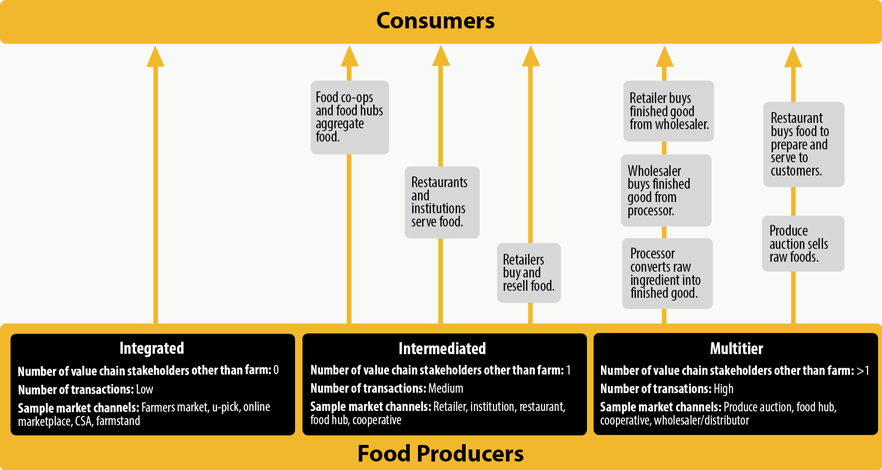

A supply chain maps how goods move from producers to consumers, and the market channels through which a food producer sells goods dictate the type of supply chains that emerge. Three categories of supply chains typically form (Figure 1).

Through an integrated supply chain, food producers directly interact with consumers and handle all supply chain functions — from transportation to marketing to sales fulfillment. Therefore, the product only changes hands once when the food producer and consumer meet. Farmers markets, u-pick, farmstands, CSAs and online marketplaces all require food producers to invest time and effort to connect directly with consumers.

In intermediated supply chains, one stakeholder, such as a business, nonprofit or individual, intersects the supply chain to link producers and consumers. Intermediaries include retailers, institutions, restaurants, food hubs and cooperatives. Food producers have fewer buyer relationships to maintain when selling into these market channels compared with market channels typical of integrated supply chains. Also, intermediaries tend to place larger orders than individual consumers.

Multitier supply chains introduce more than one entity between the farm and consumers. Those stakeholders facilitate value chain functions, including transportation, packaging and processing. The producers themselves don’t interact with consumers but only manage relationships with their immediate buyers — those entities once removed from the farm.

Figure 1 visualizes integrated, intermediated and multitier supply chains typical for food products and contrasts each type of chain based on the number of stakeholders involved, number of transactions required and aligned market channels. Note, one food producer may sell into more than one supply chain and market channel. Take the following example:

A berry farm integrates the supply chain by operating a farmstand and u-pick fields. It also sells berries to a restaurant that uses the berries in salads and acts as an intermediary between farm and consumer. Additionally, the farm supplies berries to a food hub that processes the berries into value-added products that are sold to multiple buyers, including institutions and retailers.

Market channel key features

The extent to which your farm has interest and capacity to interact with customers and handle post-farm gate activities will affect the market channels chosen.

The following sections provide information about market channels available to food producers. With this information, you’ll be equipped to identify the channels that most align with your strengths and interests. Table 1 also summarizes market channel features.

Table 1. Summary of market channels.

| Market channel | Market channel characteristic | |||||

|---|---|---|---|---|---|---|

| Suitable for large volumes of product per grower | Marketing time required by producers | Degree of producer contact with consumers | Suitable for very perishable products | Degree of price stability | Degree of public engagement | |

| Farmers market | No | High | High | Yes | Medium | High |

| U-pick | Yes | High | High | Yes | High | Medium |

| Roadside market | No | Medium | High | Yes | Medium | High |

| CSA | No | Medium-high | High | Yes | High | High |

| Online | Yes | Medium | Medium | No | High | Medium |

| Retailers | Yes | Medium | Low | Yes | High | High |

| Restaurants | No | Medium-high | Low | Yes | Medium-high | High |

| Institutions | Yes | Low-medium | Low | Yes | High | High |

| Produce auctions | Yes | Low | Low | No | Low-medium | Low |

| Cooperatives | Yes | Low | Low | Yes | High | Low |

| Food hub | Yes | Low | Low | Yes | Medium-high | Low |

| Wholesalers | Yes | Low-medium | Low | Yes | Medium | Medium |

Farmers markets

Most farmers markets require vendors to grow products within a certain distance from the market. Therefore, they create a channel for producers to market locally raised products to people in their communities. Plus, they allow consumers to connect with food providers, learn how food is raised and discover novel products. Because of their local focus, farmers markets foster community.

Farmers market vendors tend to move small product volumes — oftentimes, small amounts of diverse products. Therefore, farmers markets may not be the sole market channel used by large-scale producers. Obtaining a premium at a farmers market may be difficult if other vendors offer similar items.

Farmers markets often have rules governing how items are sold, but typically don’t require producers to follow strict grading or packaging guidelines. Barriers to entry and capital requirements are often low. Markets may charge a space or booth rental fee, but because most markets are centrally located in open-air settings, producers often find that advertising is not necessary. That said, farmers markets do require producers to spend a significant amount of time at the market to handle sales and connect with consumers (Figure 2). Therefore, not all producers may view farmers markets as an efficient use of time.

Farmers markets are usually seasonal and transient. They often open in April and close by November. However, covered farmers markets may be available year-round. Farmers markets are compatible with off-farm employment because markets often occur on evenings or weekends.

Missouri has more than 200 farmers markets, according to Missouri Grown, the state’s branded marketing program for agricultural products and experiences. To find a farmers market in your area, refer to the Missouri Grown farmers market directory.

U-pick

For some specialty crops, U-pick or pick-your-own marketing is popular. This market channel tends to work best for crops with harvest maturities that are easy for pickers to recognize. It also works well for perishable products that are susceptible to damage if handled in other market channels. Missouri farms offer u-pick options for produce including strawberries, blueberries, blackberries, apples, green beans, sweet corn, pumpkins and tomatoes (Figure 3). Some flower growers open their farms to u-pick customers, too.

The u-pick model relies on customers visiting the farm. Operations near population centers have more ready access to customers. Those located in sparsely populated rural areas may need to think creatively about how to attract enough customers to pick products.

Compared with other market channels, u-pick marketing involves relatively little capital investment, and it may offer lower harvest, transportation, packaging and marketing costs. Because u-pick farms invite the public to their operations, however, they should carry sufficient liability insurance. U-pick farms also require staff to supervise customers and show them how to harvest each crop without damaging the plants or a field’s yield potential.

Another challenge associated with u-pick marketing is coordinating harvest frequency and customer volume. Advertising will help to attract customers. However, consider parking and traffic flow patterns, so you can gauge how many guests the farm may accommodate at one time. During the COVID-19 pandemic, some u-pick farms began requesting that customers reserve picking times, so customers would have space to socially distance. Some farms have continued this practice to balance supply and demand and control crowds.

Some growers open fields to u-pick customers at the end of the harvest season to clean up fields. Alternatively, farms may work with a gleaning organization or other nonprofits, which coordinate volunteers to pick extra produce and donate it to hunger relief organizations.

The Missouri Grown u-pick directory lists nearly 80 u-pick farms that operate in the state.

On-farm or roadside markets

In high-traffic areas, Missouri growers may consider selling products through on-farm stores or roadside stands. An on-farm store can sell a variety of goods — vegetables, fruits, frozen meat cuts, value-added agricultural products and crafts — produced on the farm or neighboring farms. Offering a variety of products will attract a broad customer base (Figure 4).

Generally, marketing through on-farm stores or roadside stands requires little capital. Many on-farm and roadside markets operate seasonally, and they benefit from a steady supply of quality products. If one farm doesn’t produce enough to fill a stand, then it may buy goods from nearby growers to supplement or diversify sales. Keep in mind that roadside market prices often fluctuate during the season, based on local supply.

A farmstand requires labor through the season and a clean and neat appearance. It also would need to comply with rules, regulations and standards related to factors such as health permits, weights and measures, parking, sales tax, handicap access and sanitation.

The Missouri Grown farmstand database includes more than 100 members.

Community-supported agriculture

Missouri farms began to adopt community-supported agriculture (CSA) in the mid-1990s. In this model, consumers interested in local food enter into an economic partnership with growers who are seeking stable markets. Consumers pay in advance for a “membership” that may run for several weeks or a whole season. The fee depends on size of share and length of season. Members who buy a share receive a supply of farm products. For example, a season-long produce membership may provide six or more varieties of vegetables each week from roughly mid-May to October.

Traditional CSAs excel at creating loyal customers and friends, and they grow to become tremendous community partnerships. They typically involve core groups of consumers who not only pay the membership fee but also participate in farm activities. For example, they may provide labor for weeding, harvesting or distributing products. As a result, producers considering a CSA should feel comfortable with managing labor.

A related model called subscription farming — a more common CSA form found in Missouri — normally eliminates member work requirements. These CSAs may charge an advance fee for the entire season, or growers may opt to have a nominal membership fee and then invoice members each week or month for the market basket provided. By charging weekly or monthly fees based on the market value of goods provided, subscription CSAs exert less pressure on growers to supply product variety every week.

By offering a CSA, producers share some risk with members, who join knowing they may receive reduced harvests or variety depending on weather conditions or other variables. They also benefit because they can use CSA membership revenue as a form of financing. Upfront fees charged to members may fund seed and supply purchases and labor expenses.

CSAs in general have medium to high marketing costs but can help stabilize farm incomes, minimize risk from crop failures and provide outlets for extra product. Producers almost always pursue CSA sales in conjunction with wholesale or farmers market sales to diversify revenue streams.

To run a CSA, producers need planning and management skills. Planning is essential to provide the expected variety and quantity of goods through a season-long program. Operations that offer value-added or storable products may extend the season even further. Producing a variety of products requires knowing different growing techniques and enterprises, carefully planning production schedules and accessing enough labor.

Some producers form cooperative CSAs with other producers. This allows producers to specialize in enterprises well-suited to their land and skills but still offer variety to CSA customers. Cooperative partnerships take time to plan and manage, but much of this can be done during the offseason.

In its community supported agriculture directory, Missouri Grown lists more than 40 businesses that offer a CSA in some format.

Online sales

In 2020, 14% of U.S. farms selling food direct to consumers used online marketplaces — an increase from 8% in 2015, according to USDA Local Food Marketing Practices Survey data. The COVID-19 pandemic motivated farms to consider new markets, including those managed online, to reach buyers.

Food producers located in rural areas may particularly benefit from online marketplaces, which may connect them with consumers from population centers. In some cases, marketing goods through an e-commerce platform allows producers to make food purchases more convenient for customers. For example, online shoppers may have flexibility to choose from product delivery or pickup options and pay online to simplify transactions.

Online sales also create an opportunity for food producers to reduce some costs. Compared with in-person sales, online sales can require less transaction time and lower transportation costs. However, using an online marketplace does add some expense. Fees will vary by platform but may include a setup fee; monthly or annual subscription; and other charges based on transaction volume, sales volume and number of product listings. Before developing an online marketplace, consider whether you have the resources to maintain it and the potential to profit from online sales.

A food producer interested in online sales may choose from several models. In one case, it may launch its own e-commerce website. With this approach, the farm needs the time and knowledge to build and maintain the site, but it would also control site design and functionality. Services such as WordPress and Wix allow businesses to create their own e-commerce sites.

As an alternative, third-party services provide a framework for marketing goods online. These platforms, including GrazeCart, Harvie and Barn2Door, allow farms to create e-commerce pages where they list products. Refer to a 2021 report published by the CSA Innovation Network to learn about farms’ experiences with 12 of these e-commerce platforms.

Other platforms list diverse products from multiple suppliers. Amazon is an example. Before deciding whether to pursue Amazon sales, consider whether your product is well-suited (e.g., easy to ship, well-branded) and you feel comfortable with the platform’s practices (e.g., advertising costs, other fees, limit on collecting customer data). In 2022, the Harvard Business Review published a scorecard to help you gauge whether Amazon sales would work for your business.

While weighing online marketplace options, keep in mind the marketplace features (e.g., pick lists, inventory tracking, payment processing, shipping, customization potential, tech support) you most prefer. No one service may offer all desired functions, so understand any tradeoffs you must make.

Retailers

Many consumers request that their local supermarkets offer locally grown foods. Therefore, marketing to chain or independent supermarkets is an option for producers. Large-scale producers can market large lots of product by selling wholesale to retailers. Small-scale producers can fulfill demand for niche items (e.g., organic, grass-fed, heirloom) that retailers cannot purchase through traditional wholesale channels.

Direct marketing to supermarkets eliminates the need for a broker and allows producers to label their products. Most supermarkets require product liability insurance. Some require producers to attend food safety training; have a third-party audit; and adopt specific harvesting, packaging and handling standards. Buyers may wish to inspect the farm and discuss production practices.

To evaluate this market channel, identify all food retailers in your area. Then, visit or call each to determine interest in purchasing locally grown products. Alternatively, platforms such as RangeMe now connect suppliers and buyers. Product and business details populated into RangeMe are visible to retailers, which use the platform to scout and screen new suppliers.

When you visit with potential retail buyers, discuss supplier requirements, so you can gauge whether a retailer’s standards will work for your operation. During your discussions, buyers also will want to talk pricing. You’ll negotiate product prices with each buyer, but price levels do not fluctuate significantly.

Farms supplying product direct to retailers must consider how to best time deliveries. Supermarkets tend to require a consistent supply and quality. Some retailers will accept product delivered to individual stores, but others may ask you to drop off product at a warehouse. If selling produce, then farms must have harvest labor or equipment available on a timely basis, and they may need coolers to preserve postharvest quality. If selling meat, then consider the storage space required if you have more animals butchered than you’re able to send to market.

Restaurants

Selling to restaurants can help producers diversify their markets as many chefs have committed to local sourcing. To break into restaurant sales, consider offering samples to chefs, who can test products for quality.

Restaurants that are independently owned and operated frequently change menus and may depend on high-quality ingredients to serve a sophisticated and discerning clientele. Such restaurants tend to use a limited amount of product and have little storage space on site. Therefore, they need multiple deliveries each week. Low-price or high-volume restaurants can also be potential clients, particularly for highly perishable items such as tomatoes or strawberries that would otherwise have a high spoilage risk (Figure 5).

Benefits of marketing to chefs include earning a higher wholesale price if the product is delivered to restaurants; capturing a larger sales volume than retail sales; securing a market for unique and perishable products; and gaining exposure among a wider audience, particularly if chefs use the farm name. Chefs also offer invaluable feedback.

To sell to chefs, producers need to have good postharvest handling and sorting, grading and packaging capacity. They also need to provide a standard business invoice that can be entered into the restaurant’s accounting system. In most cases, do not expect payment upon delivery — unless you can process credit card payments. Also, consider that chefs and producers have almost opposite schedules. Chefs finish dinner service cleanup after midnight, so farmers need to be able to accept orders via an online ordering system, email or phone. Producers should also be able to provide advance product price lists and availability on a weekly basis.

Chefs expect products they order to be delivered as promised, and they need to know about product shortages far enough in advance to order replacement products from other distributors. Never deliver to a chef during lunch or dinner service (11 a.m. to 2 p.m. and 5 to 10 p.m., respectively), or you are likely to lose the sale because of inconveniencing the chef.

Institutions

Food service departments at institutions, such as colleges, schools, hospitals, workplaces and nursing homes, represent other markets for locally raised foods (Figure 6). Institutions share similarities with restaurants. Most will require product liability insurance, standard packaging and grading and readable invoices. Many use a purchase order system, which requires a grower to be an approved vendor before the institution can place an order.

Food service departments generally pay the standard wholesale price but may choose to contract for product throughout a season. The contracts can balance week-to-week price fluctuations. To protect themselves from legal claims, many food service departments require that suppliers have a hazard analysis and critical control point (HACCP) plan, adhere to Food Safety Modernization Act requirements and follow Good Agricultural Practices.

Produce auctions

Wholesale produce auctions represent an efficient market channel for growers who lack the time, resources or interest needed to directly market products to buyers. Organized as a marketing cooperative, a produce auction may be structured as a limited liability corporation or general partnership. Each auction has shareholders, usually producers, who provide startup capital.

Produce auctions allow grower-members to wholesale large volumes of produce in a centralized facility to a diverse group of buyers. The auction system is well-suited to relatively nonperishable vegetables and fruits, including top- and low-grade produce. Most auctions will only sell produce grown within 100 miles of the auction facility. Produce grown outside the 100-mile radius is considered “shipped or imported produce” and is usually auctioned after local produce. Growers who wish to sell produce grown more than 100 miles away should first contact the market manager. During the peak growing season, produce auctions may have two or three sales per week. Often, auctions host special events for items such as flowers, bedding plants, small animals, hay, straw and crafts. Most auction buyers purchase for small supermarkets, roadside stands or restaurants.

Before an auction, grower-members must follow auction guidelines for grading and packaging produce in standardized containers. The auction often sells the required containers or boxes to producer-members. Growers transport produce to the auction building the morning of the auction, and the auction commences by midmorning. They are responsible for boxing, unloading, stacking and labeling their produce items. An auctioneer sells produce in lots positioned on carts or in a drive-through for bulk wagons or trailers.

Each lot of produce has a card that identifies the product type, quantity, grade and sometimes variety. Known as the consignment sheet, this card is read aloud by the manager or auctioneer before auctioning the lot. Each tag has a number that identifies the grower. Each lot is systematically auctioned to the highest bidder. Although the auction is designed for wholesale marketing, small lots of produce are sold at retail prices in a separate section of the facility. Because most buyers want larger volumes of produce, most auctions sell small lots — less than three boxes of any item — last.

Most auctions have a “no no-sale” policy, meaning every lot is sold by the end of the auction regardless of price. Some auctions choose to set a price floor or minimum acceptable price for each lot. Given the auction system’s nature, prices can vary, but an auction with low prices is often followed by auctions with high prices. At most auctions, average seasonal prices for produce are usually above wholesale final market prices or prices received from supermarket contracts. Therefore, growers should sell at auctions throughout the growing season to balance high and low prices.

Auctions charge a 9% to 12% commission, which is deducted from the sale price of each lot, to fund operating costs and salaries of the market manager, clerks and other auction workers. Although growers must pay the commission, the total transaction costs incurred from produce auction sales are relatively low because they transport produce to a central facility, not specific customers or markets.

Cooperatives

Owned by producer-members, cooperatives collectively market products raised by their members. Producers in a region who raise similar products (e.g., vegetables, fruits, pork, beef) or use similar growing practices (e.g., organic) may consider establishing a co-op, which may be structured as a partnership, corporation, cooperative or limited liability company.

The quantity of product a producer markets through the cooperative depends on how much the producer invested in the co-op. The co-op itself must implement a marketing agreement, which specifies the type and volume of product sold by each member. For the cooperative to succeed, producer-members must work together and put aside self-interest. They also should use the cooperative as their dominant marketing outlet.

The cooperative structure allows producers to sequence their production output to maintain a steady supply of product for each market. Some cooperatives do not take possession of members’ product but only connect members with buyers. Cooperative marketing can benefit growers by allowing them to specialize in offering products best suited to their farm resources, available labor and management skills; market a larger product volume; and spread equipment and facility investment costs among more producers.

Most wholesale markets desire consistent product quality and quantity. Therefore, quality control is essential, and the cooperative must enforce grading and packing requirements. Through a co-op, producers may also label and differentiate their products. Additionally, the cooperative can help with harvesting, processing, cooling or freezing, packaging, labeling and transporting products. Depending on its size and scope, a co-op can have significant capital requirements for investments such as packing equipment, freezers and coolers.

The cooperative has a market manager who coordinates production and seeks new markets for co-op members. With a diligent market manager and a pooled volume of output, each producer-member spends less time marketing. As another benefit to producer-members, cooperatives can purchase inputs, such as fertilizer or seed, in bulk. When it resells those inputs to members, producers pay significantly lower prices than they would if they had purchased inputs without the co-op’s bargaining power on their side. Co-op members may also pool and share labor and equipment.

Food hubs

Through a food hub, participating producers from a particular region or locale pool their products and collectively market and distribute large volumes to buyers, including wholesalers, retailers and institutions.

Food hubs uniquely provide aggregated volumes of source-verified food with a brand behind it. For buyers, the food hub may introduce some purchase efficiencies because buyers may interact with one contact at the food hub rather than connect with multiple producers.

In addition to aggregating products, food hubs provide other benefits to producers. Some offer transportation and distribution options, brokerage services, technical assistance, liability insurance coverage and access to processing capacity. Regarding distribution, some food hubs may accept deliveries from producers at a centralized facility, but others may offer on-farm pickup. The extent of processing or value-added services also varies by food hub. Some may collaborate to develop value-added products. Light processing or whole foods may be the focus for others. Depending on the scope of services offered, food hubs may have varying capital requirements. Successful food hubs scale their infrastructure investment as they grow and think strategically about how investments will build on one another.

Most often, food hubs are organized as privately held businesses, nonprofits or cooperatives. A successful food hub will requires managers who understand food production and contribute business acumen. Manager responsibilities include planning for the season, pricing products, overseeing distribution, keeping records, meeting regulatory requirements, controlling product quality and communicating with stakeholders.

The USDA Agricultural Marketing Service maintains a Local Food Directory. In it, you can search for operational food hubs in your area.

Wholesalers and distributors

Typically, wholesalers and distributors purchase large volumes of product at relatively low prices (Figure 7). They then resell those products to buyers including grocery stores, retailers and institutions.

To sell into wholesale markets, food producers must meet certain qualifications. Those include following food safety guidelines, carrying the appropriate insurance and using the right packaging and labeling. Transportation requirements vary. Some wholesalers and distributors require food businesses to ship their products to a central warehouse, which handles further distribution. Others pick up product from food businesses.

Overall, succeeding at wholesale marketing requires food businesses to develop good relationships with wholesalers and distributors. Both the food business and the wholesaler or distributor must understand the other’s obligations and plans. Start connecting with these buyers early — before your production season begins — to request a meeting. Use the time to introduce your business, explain your products and share your volume targets. If you decide to work with a wholesaler or distributor, then you can collaborate to do more detailed production planning and set expectations for in-season communication about product availability.

Food producers may hire an internal sales team to coordinate sales to wholesalers and distributors or engage a third party. Brokers often work as third-party market-makers. They never “own” the products they market for food businesses. Instead, the scope of a broker’s responsibilities includes arranging sales, coordinating distribution and serving as the liaison between the food business and wholesale buyer. The broker receives a commission for the product he or she arranges for sale on the food business’ behalf.

Sources

- Agricultural Marketing Resource Center.

- The Agricultural Marketing System, Seventh Edition. 2015. Rhodes, V. James; Dauve, Jan L.; and Parcell, Joseph L. University of Missouri, Columbia, Missouri.

- Building a Sustainable Business: A Guide to Developing a Business Plan for Farms and Rural Businesses (PDF). 2018. Minnesota Institute for Sustainable Agriculture.

- Choosing Wholesale Markets for Local Food Products. 2019. Lamie, Dave; Ernst, Matt; Woods, Tim; Bullen, Gary; and Lanford, Blake. Community, Local and Regional Food Systems: A National Cooperative Extension Project Team.

- Community Supported Agriculture. National Agricultural Library.

- Community Supported Agriculture (CSA): An Annotated Bibliography and Resource Guide (PDF). 1993. DeMuth, S. USDA: National Agricultural Library.

- Could Online Sales Be a Direct Marketing Opportunity for Rural Farms? (No. G6224). 2020. Low, Sarah A., and Thompson, Kate. University of Missouri Extension.

- Farmer and Buyer Toolkit for Wholesale Readiness. Iowa State University Extension and Outreach.

- Farmer to Farmer Exchange: E-Commerce Platforms Report. 2021. CSA Innovation Network.

- The Farmer’s Legal Guide to Producer Marketing Associations (PDF). 2005. O’Brien, D.; Hamilton, N.D.; and Luedeman, R. National Agricultural Law Center.

- Farmers’ Markets: Rules, Regulations and Opportunities (PDF). 2002. Hamilton, Neil D. National Center for Agricultural Law Research and Information Center.

- Food Hubs: 10 Lessons on Viability. Federal Reserve Bank of St. Louis.

- Getting Started with Online Farm Sales During Times of Social Distancing. 2020. Errickson, Lauren B.; Hlubik, William; Nitzsche, Peter; and VanVranken, Rick. Rutgers, New Jersey Agricultural Experiment Station.

- Growing for Market. A newsletter and website for produce growers. Toll-free: 800-307-8949.

- How to Sell Produce to Distributors. 2018. Kure, Keirstan; Horning, Lauren; and Dunning, Rebecca. North Carolina State Extension.

- The Legal Guide for Direct Farm Marketing. 1999. Hamilton, N.D. Drake University Agricultural Law Center, Des Moines, Iowa.

- Management Considerations for Implementing E-Commerce in a Food or Farm Business. 2020. PennState Extension.

- Marketing Fresh Produce Via Direct to Consumer and Intermediated Markets. 2022. Borgman, Mariel. Michigan State University.

- Marketing Options for Commercial Vegetable Growers (PDF). University of Kentucky Cooperative Extension Service, publication ID-134.

- Missouri Farm to Institution: Clearing the Path for Marketing Directly from Missouri Farms to Institutions. University of Missouri Interdisciplinary Center for Food Security.

- Missouri Grown. As Missouri’s state branding program, Missouri Grown catalogs members’ food products.

- National Cooperative Business Association. Information on forming a cooperative business.

- The Role of Food Hubs in Local Food Marketing (PDF). USDA Rural Development.

- Show Me Food. On this website, list the local food products you offer, and buyers may discover your operation.

- Should Your Company Sell on Amazon? 2022. Israeli, Ayelet; Schlesinger, Leonard A.; Higgins, Matt; and Semerkant, Sabir. Harvard Business Review.

- Successfully Direct Marketing Beef (No. MX3000). 2021. Middleton, David. University of Missouri Extension.

- To Market, To Market: A Workbook for Selecting Market Options and Strategies for Agricultural Products (PDF). Rutgers.

Original authors: Mary Hendrickson and Lewis Jett with substantial revisions by Alice Roach and Joe Parcell